There are three sides of risk management that are crucial to understanding before you trade.

- The odds you will have a losing trade.

- The average size of the loss you will experience.

- The odds you will blow up your account.

The odds you will have a losing trade is your percent of losers. Whether projected based on backtesting or your trading history, this is a crucial number to know for your trading psychology and position sizing. No real trader wins on every trade or investment and it is important to have realistic expectations on how many times you will lose. If a trader was taking random entries and exits they should lose about 50% of the time just like a coin flip.

If you are working on a high win rate trading system you should be doing better if you are looking for a trading system with huge winners you might actually do worse. It is not the amount of your winning trades that determines your profitability it is the size of your profits versus your losses. You must have realistic expectations on your winning percent before trading to understand the impact of your losing frequency.

The average size of the loss you will experience has a lot to do with your position sizing. If you know you will have losing trades then the next question is “How big will they be?” If you think 40% of your trades are going to lose based on your system and the average loss on a stock’s movement is going to be -5% approximately when your stop loss is triggered then you can decide on proper position sizing parameters to manage size of losers.

If your position size was 10% of trading capital and the stock is down -5% then you will have a half percent loss of your total trading capital or -0.5%. If your position size was 20% of trading capital and the stock is down -5% then you will have a one percent loss of your total trading capital -1%. Understanding the frequency and magnitude of your losses on average can help you manage your losses both psychologically and financially.

The odds you will blow up your account may be the most important thing to know. This is your risk of ruin. When one loss or a sequence of losses brings your trading account down to an unrecoverable amount then you are theoretically ruined. Long term survival is a more important thing to consider in trading than short term profitability.

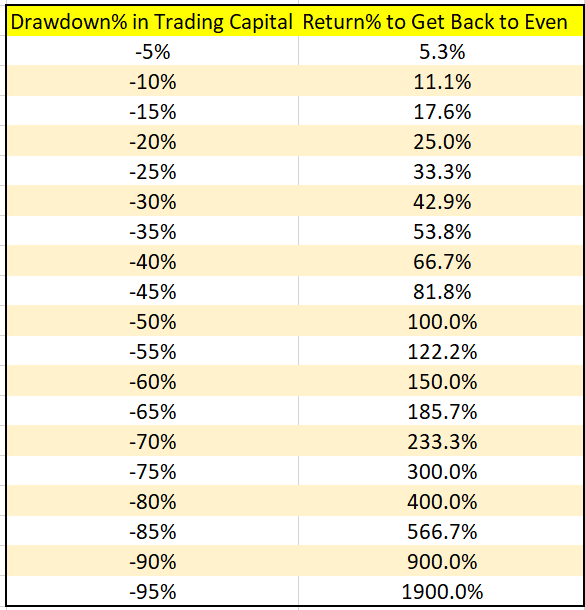

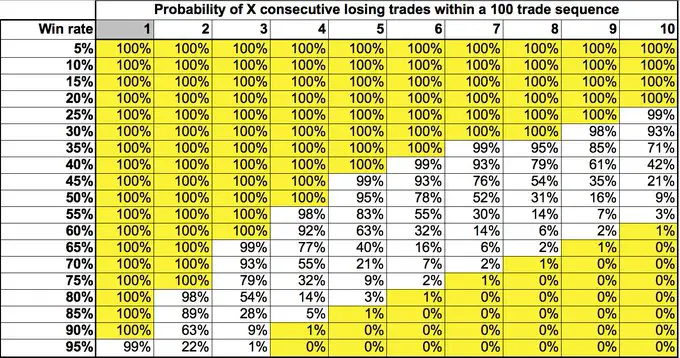

A 60% win rate system with 40% losing trades has a 1% chance of having 10 straight losing trades out of every 100 trades. If your risk per loss was 1% max of trading capital your drawdown would be 10% and need about an 11% return to get back to even. If your risk per loss was 2% max of trading capital your drawdown would be 20% and need about an 25% return to get back to even.

If your win rate and loss size shows the probability of you having a -50% drawdown in capital at some point that is ruinous for most traders. A trader would need a +100% return on capital just to get back to even after lose half their capital.

Manage your losing percent, the size of your drawdown, and your risk of ruin to give yourself the opportunity to keep the profits you make in the markets and not just eventually give them all back.

Here is a link to my full risk management book.

Probability of a losing streak based on win rate.