The bearish butterfly option play, (not to be confused with the bearish butterfly chart pattern) is an adjusted butterfly option spread which is a neutral options trading play that is structured to profit from bearish price action. Option traders create this option play when they have bearish signals on a chart pointing to the market going lower. They make projections for a low price at an oversold level or previous support area and structure their bearish butterfly to be profitable as long as price doesn’t go below that level.

There are three option contracts used to construct the bearish butterfly, it is more complex than option plays with only two parts (legs). This strategy has a low cost to open. A bearish butterfly can be opened using put option contracts or call option contracts for a similar risk to return ratio.

Here is an overview of the bearish butterfly option play:

- This is a bearish option play profting if price stays above a specific price level.

- It is a complex strategy requiring an understanding of option theta, delta, and gamma for risk management.

- It contains three options: long puts/short puts/long puts. (Or calls).

- Upfront debit spread cost to open.

- Profit accrues as theta decays on the short options when it is not replaced with intrinsic value.

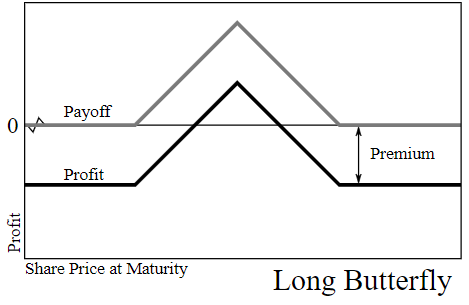

The bearish butterfly option spread is a play to profit from theta decay by betting a stock will not get to a specific price in a certain timeframe. It is built with two long “wings” and a middle “head” that looks like a butterfly on the option chart. In this play the option trader is a capped risk due to the long option hedges.

The cost of margin to open this play is low so it is possible to get a large percent return on a small amount of capital if successful. However the profit potential is limited to the option premium sold minus the cost of the long option hedge premium. It is not ideal if the chart falls more than you anticipated even with your hedge as insurance, maximum profit is if all options expire worthless at the strike price level of the short options strike.

There are three option transactions needed to build a bearish butterfly spread play. The first step is to pick what price level the underlying stock could drop to in the timeframe of your choice. Then sell puts short with the strike price above your target price low at the expiration date you have chosen. For every two put options you sell you buy one put option with a strike price higher and one with a strike price lower to hedge for losses from an outsized more. All the options in your play should expire at the same time.

Look for strikes that are close to each other in strike. The cost of buying the long puts as hedges should be covered with the credit you received from writing the short options. There should be a small net debit to open the total play. You can open the play with calls or puts but the profit potential should be about the same but sometimes you will see a higher skew toward higher put premium.

If the price ends out-of-the-money for your short puts this makes the puts you sold worth nothing at expiration. This would also cause the long puts at the lower strike to expire worthless. Lastly, the long puts you bought at the higher strike level will then expire in-the-money for a profit of intrinsic value on that option. The theta decay from your short options needs to be greater than the debit cost to open the play to make money.

The maximum loss for this option play is capped at the total net debit paid when opening it. The maximum loss happens when the underlying stock goes up or down in price enough for the short options to go too deep in-the-money. When both the long option wings and the middle short options expire out-of-the-money and worth nothing you make your maximum return.

You also lose your initial capital if the price of the underlying stocks drops too far below the strike price of the lowest strike option as this will result in the short options going too deep-in-the-money equaling the return of the long option wing.

When opening this option play you will have two break even price levels and as long the price of the underlying stock is lower than the higher break even price and higher than the lower break even price the play will be profitable.

If the underlying price is close to the middle strike of the put options you sold short to open, the higher your profit will be. You will know how much money you have at risk as the maximum that can be lost is capped to the cost of opening the spread.

There are three option trades needed to open this play so you have to consider commission costs as part of our expenses that will cut into your profits. It is also important to only trade liquid option chains with tight bid/ask spreads as it can be very expensive to get in and out with wide contract spreads.

It is crucial that price ends inside the profit zones for this play to make money, an option trader that opens a bearish butterfly option play wants to see a flat or slightly down price not a market trending up or down.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.