Implied volatility or IV crush are descriptions for when an options vega premium dropped dramatically out of its pricing. This usually happens after a major event has passed for the underlying stock or market for the option contract. The most common time to see IV crush in a stock option is after an earnings announcement for the underlying company.

An IV crush happens because the Vega in the options pricing model tries to project the potential move after earnings into an option price. Option sellers have to be compensated for the uncertain risk of the potential future price action of a stock after earnings.

The at-the-money options in an option price chain reflects the implied move in a stock after earnings, If a stock is trading at $100 a share and the $100 strike call option and $100 strike put option (front month) are trading at $110 ($1100 for a 100 share contract) the day before the earnings announcement then a approximate $10 move in the stock is priced into Vega (excluding Theta). Implied volatility is directionally neutral so both calls and puts price in the vega premium. The magnitude of a move is priced in but not the direction.

In the above example, if after earnings the stock opens up at $110 then the $100 strike call option will be priced at approximately $110 ($1100 for a 100 share contract excluding any Theta). In this example the vega premium is priced out and has been replaced by intrinsic value as the at-the-money call option has gone $10 in-the-money after earnings.

It is difficult to make money buying options and holding through earnings as the implied volatility is priced in. To be profitable on a long options play the intrinsic value gained after earnings has to be enough to replace the lost vega and you must get the direction correct. Many option traders prefer to sale option premium before earnings like short option straddles or short option strangles to profit from IV crush. With that type of short option play it is crucial to hedge the risk with long farther out-of-the-money options in case there is an outsized parabolic move beyond the parameters of the vega pricing.

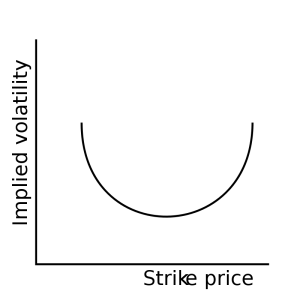

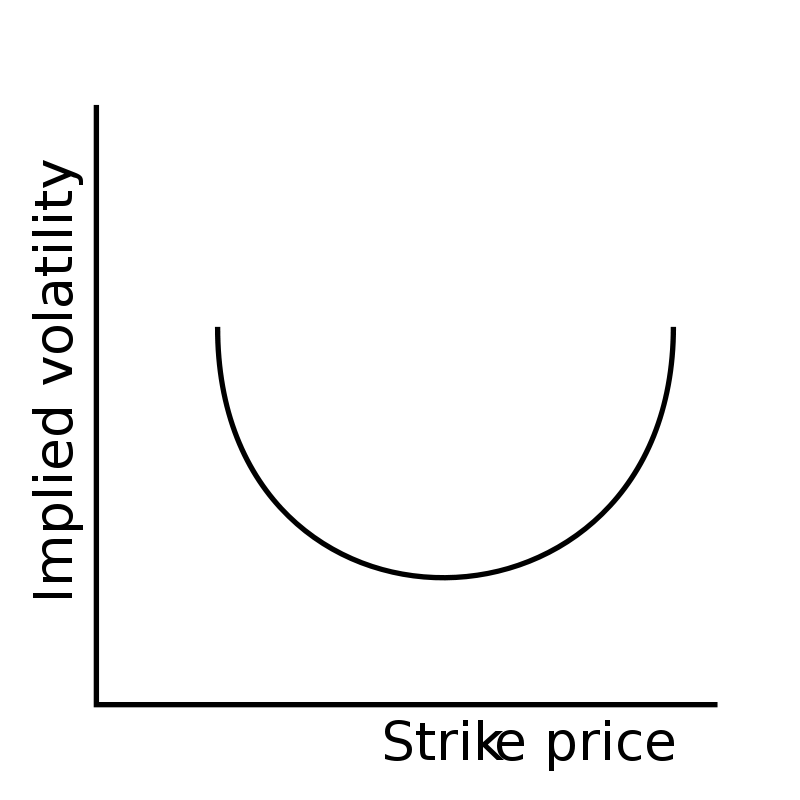

After an earnings announcement the implied volatility pricing curve for the Vega value of an options chain is crushed.

I have created the Options 101 eCourse for a shortcut to learning the basics on how options work and how to trade them.