M. W. Toews / CC BY (https://creativecommons.org/licenses/by/2.5)

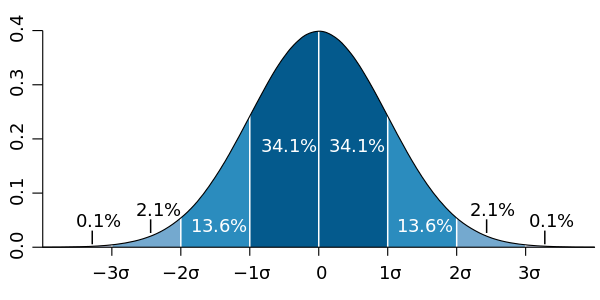

Here is a quick overview for an understanding a standard deviation chart data set. You can see how the examples of the data will fall within one standard deviation of the mean for approximately 68% of the data set, staying within two standard deviations happen with approximately 95% of the data set sampled, and all the data samples will usually fall within three standard deviations approximately 99.7% of the time.

The standard deviation identified on the chart as σ (the Greek letter sigma) is the square root of the variance of X, this is the square root of the average value of (X − μ)2. The standard deviation of a probability distribution is the same as that of a random variable having that distribution. A move of a 3 sigma event is three standard deviations from the mean.

For traders and investors looking at the probabilities of price changes as they are usually distributed within the parameters of a classic bell curve then approximately 68% of price action will be within one standard deviation of the mean, approximately 95% will be contained within two standard deviations of the mean, and approximately 99.7% will happen inside three standard deviations of the mean. With these parameters of deviations traders and investors can see the magnitude of a price movement away from the normal value zone for the time frame of a market. A price move bigger than one standard deviation shows that strength or weakness is greater than the average in the direction of the price movement and trend.

Trend traders look for outsized moves of magnitude of 3 or more deviations from the mean that do happen more than expected. When a large move happens they do create huge big winning trades and investments. These large outsized moves come more than are expected and are called “Fat Tail” or “Black Swan” events.

Bollinger Bands and Keltner Channels are technical trading tools for measuring standard deviations with ‘envelopes’ plotted on a chart. These technical indicators that create price envelopes show visual upper and lower standard deviations from an average of price. They both use two parameters, both period and standard deviations and these are set at default values of 20 for the period with 2 as the standard deviations, but these can be adjusted for time frame or a larger or smaller deviation parameter.

The indicator bands adjust to volatility swings in the underlying price by expanding and contracting. These technical measurements are primarily used for reversion to the mean trades and tend to quantify how far price has pulled away from a key moving average and the odds of a return to the value zone.