Bruce Kovner was one of the biggest traders in the world in the interbank currency and futures markets during his career according to author Jack Schwager. He is the founder and chairman of Caxton Associates, a global macro hedge fund. Kovner retired from the hedge fund in 2011 after managing it for over 30 years.

In 1987 he had profits of over $300 million in the funds he managed. Kovner had a compounded average 87% annual return in the ten year period before he was featured in the Market Wizards book in 1989. Just $2,000 invested with Kovner in early 1978 would have grown to being over $1,000,000 ten years later through the magic of compounding returns.

Bruce Kovner’s current net worth is approximately $5.3 billion dollars.

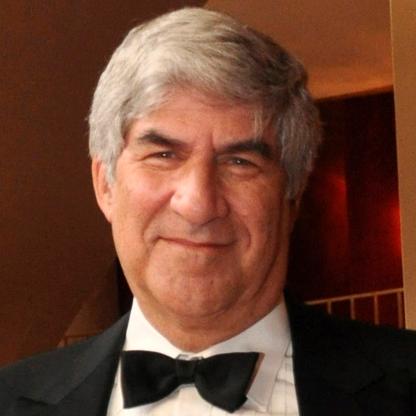

Market Wizard Bruce Kovner

Here are a list of ten of the most powerful price action trading quotes from Market Wizard Bruce Kovner. They can help give us some insights into the key principles he used for outsized returns in trading and growing capital into amazing amounts of wealth for himself and his investors.

“The first rule of trading – there are probably many first rules – is don’t get caught in a situation in which you can lose a great deal of money for reasons you don’t understand.” – Bruce Kovner

“If you don’t work very hard, it is extremely unlikely that you will be a good trader.” – Bruce Kovner

“If you personalize losses, you can’t trade.” – Bruce Kovner

“Risk management is the most important thing to be well understood. Undertrade, undertrade, undertrade is my second piece of advice. Whatever you think your position ought to be, cut it at least in half.” – Bruce Kovner

“Novice Traders trade 5 to 10 times too big. They are taking 5 to 10% risks on a trade they should be taking 1 to 2 percent risks.” – Bruce Kovner

“In a bear market, you have to use sharp countertrend rallies to sell.” – Bruce Kovner

“Michael Marcus taught me one other thing that is absolutely critical: You have to be willing to make mistakes regularly; there is nothing wrong with it. Michael taught me about making your best judgment, being wrong, making your next best judgment, being wrong, making your third best judgment, and then doubling your money.” – Bruce Kovner

“Fundamentalists who say they are not going to pay any attention to the charts are like a doctor who says he’s not going to take a patient’s temperature.” – Bruce Kovner

“My experience with novice traders is that they trade three to five times too big. They are taking 5 to 10 percent risks on a trade when they should be taking 1 to 2 percent risks. The emotional burden of trading is substantial; on any given day, I could lose millions of dollars. If you personalize these losses, you can’t trade.” – Bruce Kovner

“The Heisenberg principle – If something is closely observed, the odds are it is going to be altered in the process. The more a price pattern is observed by speculators the more prone you have false signals; the more the market is a product of non-speculative activity, the greater the significance of technical breakout.” – Bruce Kovner

“Whenever I enter a position, I have a predetermined stop. That is the only way I can sleep. I know where I’m getting out before I get in. The position size on a trade is determined by the stop, and the stop is determined on a technical basis. I never think about other people who may be using the same stop, because the market shouldn’t go there if I am right.” – Bruce Kovner