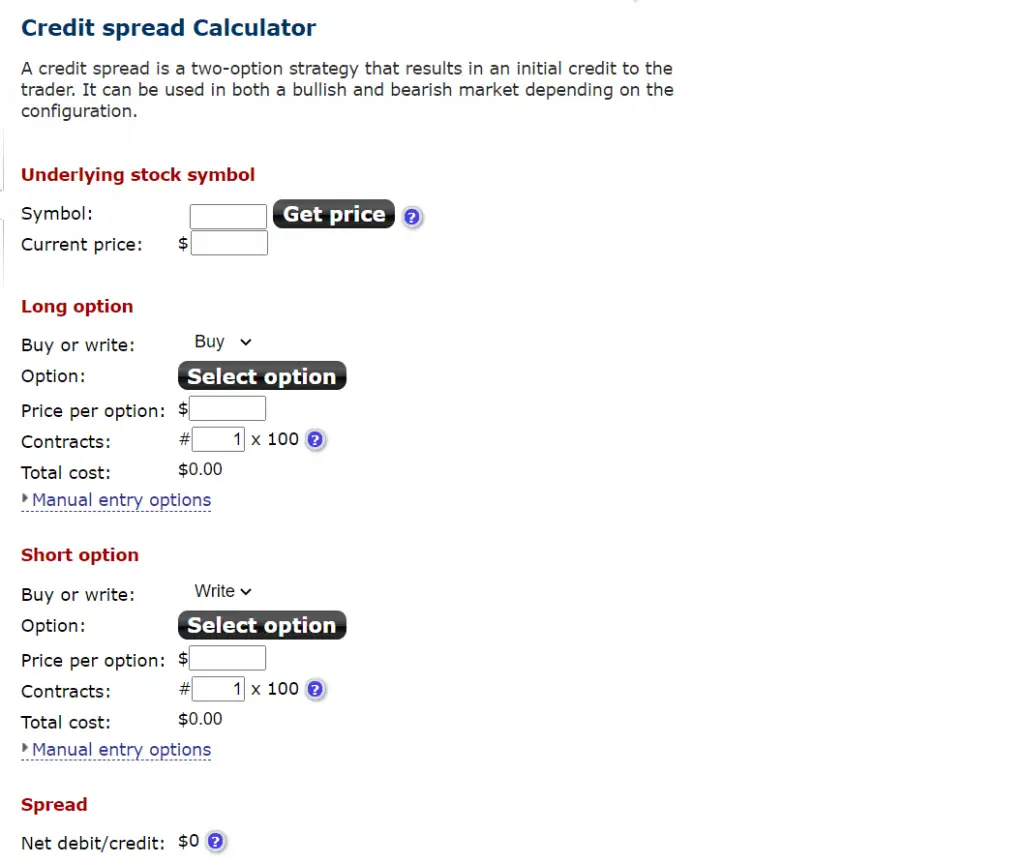

An online options profit calculator can help with the math of understanding the dynamics of an option play from opening it until it is closed and whether it is profitable.

An option play can be long or short with one leg (position), it can be a spread with more than one leg (positions), or a more complex play with three legs or more.

An option play can be directional, non-directional, a bet on a price target, a trade based on time decay or a change in volatility. An option calculator can help understand the changes of the Greeks as the price action on the underlier changes.

An options calculator can help you quickly understand your play and its cost to open.

An option play doesn’t stay stagnant as the Greeks constantly move and change over time whether due to implied volatility expansion or contraction, time decay, or price momentum. It is crucial to track all the Greeks and your change in risk exposure with open profits, Delta expansion, or a volatility spike.

Option plays have to be managed in real time to maintain risk management and profit taking.

Here is the link to a great options profit calculator at https://www.optionsprofitcalculator.com/.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.