To manage the risk of ruin in trading position sizing should be managed to never lose more than 1% to 2% of total trading capital on any one trade. If a stock trader has a $100,000 account, they should position size and set stop losses to limit losses to no more than $1,000 in a trade. A stop loss level has to start at the price level that what signal a trade is wrong, and work back to position sizing.

To manage the risk of ruin in trading position sizing should be managed to never lose more than 1% to 2% of total trading capital on any one trade. If a stock trader has a $100,000 account, they should position size and set stop losses to limit losses to no more than $1,000 in a trade. A stop loss level has to start at the price level that what signal a trade is wrong, and work back to position sizing.

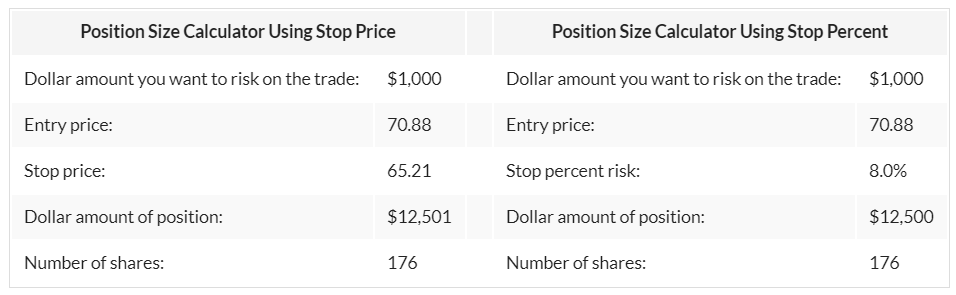

If the key price support level on your stock is $100 and you buy a stock at $105 you set your stop loss at $100, then you can trade 200 shares with a stop at the $100 price level. 200 X $105 = $21,000 position size for 200 shares. This is about 20% of your total trading capital with about a 5% stop loss on your position that equals a 1% loss of your total trading capital.

A percentage of total trading capital for position size and the percent of loss of a stock price in correlation to position size is the most simple way to quantify risk.

- A 20% position of your total trading capital gives you a potential 5% stop loss on your position to equal 1% of total trading capital.

- A 10% position of your total trading capital gives you a potential 10% stop loss on your position to equal 1% of total trading capital.

- A 5% position of your total trading capital gives you a potential 20% stop loss on your position to equal 1% of total trading capital.

- A 20% position of your total trading capital gives you a potential 10% stop loss on your position to equal 2% of total trading capital.

- A 10% position of your total trading capital gives you a potential 20% stop loss on your position to equal 2% of total trading capital.

The average true range (ATR) can give you the daily range of price movement and help you position size based on your time frame and your stocks volatility. If your entry is $105, your stop is $100, and the ATR is $1, then you have a five days worth of movement against you as a stop.

Another location is to place a stop loss at a key previous price support on a chart to establish risk on a trade.

Start with your stop loss level and volatility to give yourself your position size. The more room you want on your stop determines how big of a position size you can take.

If you only risk losing 1% of your trading capital when you are wrong, then every trade can become just one of the next 100 with little emotional impact. If you only risk losing 2% of your trading capital when you are wrong, then every trade can become just one of the next 50 trades. Ultimately, you can survive losing streaks and increase your odds of long term profitability.