How does short selling work? Selling short reverses the normal order of buying and then selling. Selling short means to sell something you do not own. When you sell a stock short you borrow the stock from your broker and sell it to a buyer. You then owe the broker the shares. You receive cash from the sale but have to use it to buy the shares later to pay back your broker for the loan. You are long cash and short the shares on a short trade.

Selling a stock short can confuse new traders as it can be hard to understand how you can sell something you don’t own. To sell a stock short you first must have a margin account with your broker. You will need to open a margin account to sell stocks shorts because you need a loan to sell shares you don’t own. You must first borrow the shares. Margin requirements are a type of loan that is collateral that backs the short position and provides safety that the borrowed shares will be returned to the owner. FINRA requires brokerage accounts to maintain a minimum 25% of the shorted stock value with cash in the trading account. If you sell short a stock position valued at $10,000 you must have a minimum of $2,500 in cash deposited in your account at all times.

After you have set up your margin account and have enough cash to cover the short position then you can type in the ticker symbol and click the ‘sell short’ button. Your broker will have to find shares to ‘borrow’ from another account and then sell them in the market, the proceeds from the sell will be your credit from the short sell but you have to ‘buy to cover’ the position later. A short sell can only be executed if your broker can locate shares to borrow and sell short for you. Some shares are too illiquid and don’t have shares available to short.

When you ‘buy to cover’ the short position that will be your debit purchase price to buy back the shares you were short in the open market, then your broker can ‘return’ the shares to the account they were borrowed from. This is all done electronically today and is computerized and automated.

A short sell reverses the sequence of trading, you sell first and then buy later. If you sell short for a higher price than you buy it back later for you have made money. While you are short a stock you also will have to pay margin interest on the position size held. You will also have to pay any dividends due on the stock during the time period you are short.

Selling short and buying back at lower prices in the stock market can be more difficult than buying and selling at a higher price as the stock market tends to go up or sideways the majority of the time. Bull markets are long and bear markets are short. Stock market sell offs and corrections tend to be brief in time span and volatile in movement and also have big rallies many times even as they go down.

Most of the time the long side is the most profitable to trade in the stock market. Also the math for returns on the long side are more favorable as the upside of a stock is unlimited. A stock priced at $10 that you buy that then goes up to $110 is a 1,000% return on capital. A stock priced at $100 that you sell short that falls to $10 is a 90% return on your capital. The upside returns for long positions are uncapped while the most you can return on a short position is 100% if the stock goes to zero. Long side position losses are capped at 100% if your stock goes to $0 but the short side is uncapped as a stock can go up to any price in theory, that is why it is crucial to use a stop loss on short positions to cap your losses.

Another way to profit from selling stocks short is to buy put option contracts explained here.

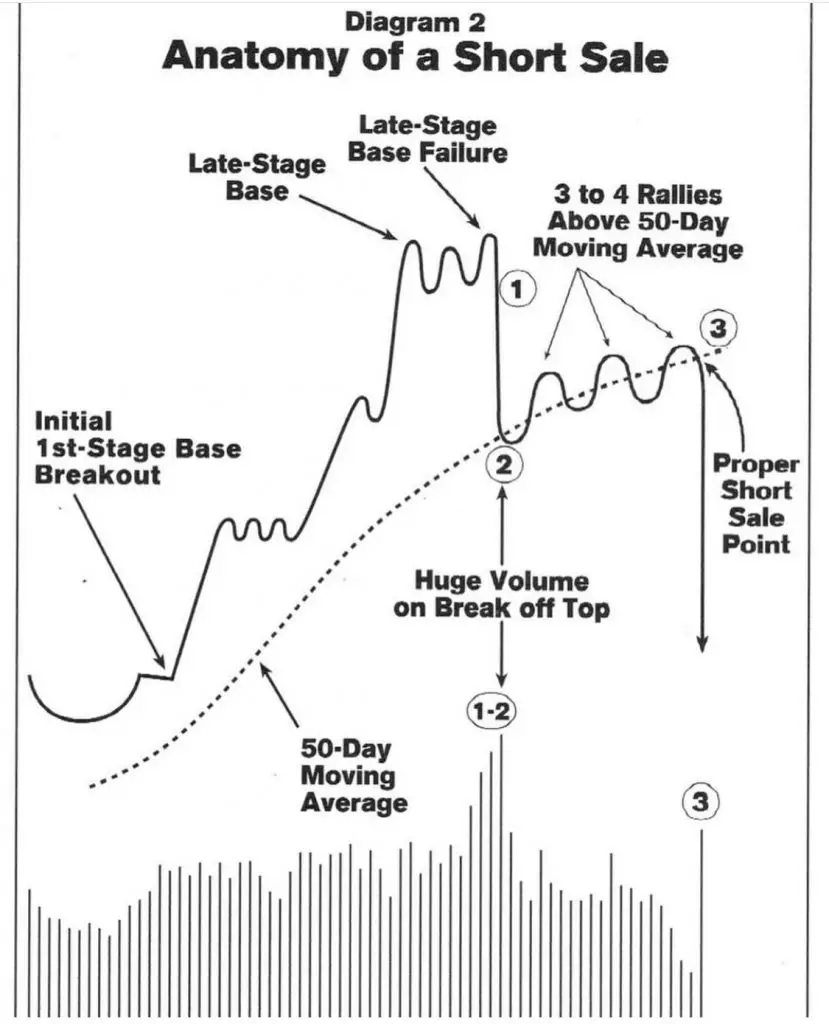

From the book How to Make Money Selling Stocks Short