A trading journal is a trading book you write about yourself. A trading journal has two uses, the first is to move your feelings, thoughts, and ego issues out of your mind and on to paper so you can see patterns of psychological error. Creating a profitable trading system is only the first step to successful trading, the second step is following your entries, exits, and position sizing with discipline.

The mental side of trading can be harder than the math. The stress caused from putting real money at risk can cause your ego and emotions to be barriers to success. A trading journal can show you the patterns of errors, being aware of the errors of your mind is the first step in fixing them.

Creating a trading system with an edge and following that plan consistently are two very different things. The primary causes of being an unprofitable trader are having no edge, mental mistakes, and bad risk management. A trading journal can document your errors and show you where you are going wrong in any or all of these areas. In our modern era we no longer have to rely on pencil and paper for a trading journal there are many more advanced options.

With the data from good trading journal software you can see both when you were successful and when you failed and why. The goal of good trading is not to make money every time but to follow your own trading plan with discipline every time. The data from your trade executions can show patterns of success and failure like when you let a loss go on too long and when you should have let a winner run.

If you have a system with a edge and follow your process you will make money over the long term. You will lose money if you have no edge or if you have an edge but lack the discipline or risk management skills to implement it.

The more powerful your trading journal the faster you can identify and correct the patterns of errors in your trading actions.

To improve on your trading psychology for each trade you should be logging and quantifying these actions:

- Document your entry signal on the chart.

- Why you chose to enter at that price.

- How do you feel on entry? What are your expectations?

- Your position size and why.

- Your initial stop loss plan if you are wrong.

- Your profit target expectation on entry or how you plan to trail your stop loss higher for a winning trade.

- What is your risk/reward ratio based on your entry level versus your first profit target?

- Document your exit signal on the chart.

- How did you feel on the exit?

- Did you commit any errors of execution?

- What would you have done differently to minimize the size of a losing trade?

- What would you have done differently to maximize the size of a winning trade?

- Do you have any regrets?

- What were your thoughts during each phase of your trade?

- Did you have confidence in yourself to follow your trading plan?

- Do you have faith in your trading system to make money over the long term?

- Are you comfortable mentally and emotionally trading in this timeframe?

- Are your trades within your risk tolerance and return guidelines?

- What was your stress level from 1-10 during each step of the trade?

- Does your trading method align with your own beliefs about the markets?

“Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible” – Ed Seykota

After you have your trading psychology right the next step is to look to improve on your trade execution. The second part of your trading journal requires software to really dig into the math of your trading and quantify your metrics and show you where you can improve on the math of your edge implementation.

The most important metrics to track with your trades:

- Position sizing.

- Risk/reward ratio.

- Profit factor.

- Winrate.

- Size of profits and losses

- Trade frequency.

- Watchlist winners and losers.

- Time of day winners and losers.

- Best trade setups.

- Trade management review.

“If you can’t measure it, you probably can’t manage it… Things you measure tend to improve.” – Ed Seykota

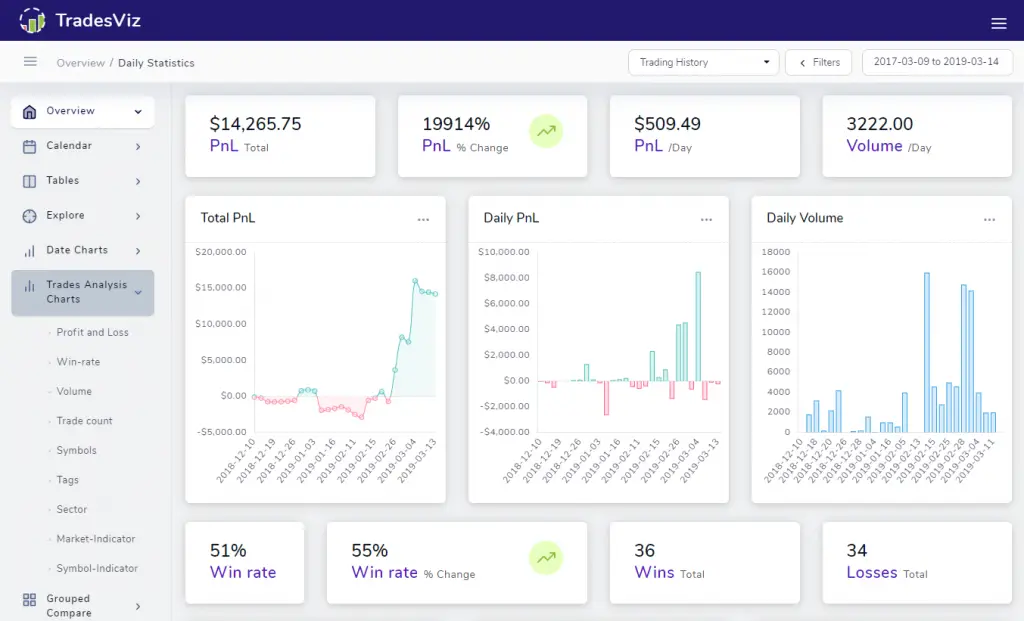

TradesViz is a tool to help you log, visualize and analyze your trades all in one place. Upload images, charts and draw/write on them with their custom built editors – no more manually storing files or images in 10 different folders! You can share your trading days, trades, and setup mentor-trainee account sharing with other traders on TradesViz.

The TradesViz. platform gives you the tools to analyze your trading patterns and learn why a particular metric of your trading changes. Their custom made compare groups feature lets you compare up to 4 different groups of trades where you can set specific filter settings and compare 1000s of trades verses each other and to pinpoint your strengths, weaknesses and make note of them.