Pure price action signals use the current price alone to indicate when to get in and when to get out of a trade. It is possible to use pure price action signals to create systems for entry and exit signals to trade.

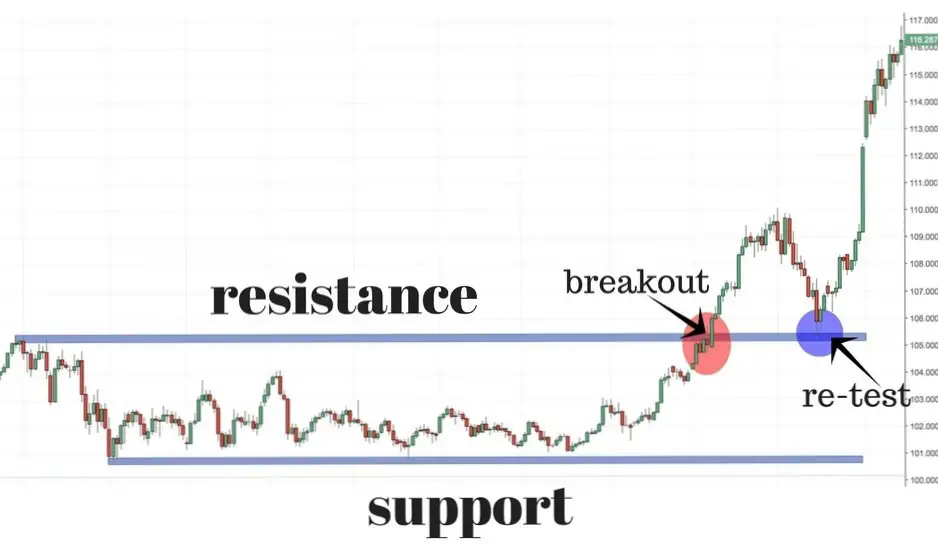

A range trader will use a repeated price level that hasn’t broken as a key resistance level to short and a price level that repeatedly can’t be broken as a key support area to be bought inside their trading timeframe. A break of either of these key levels could signal a breakout to a possible new trend in price. A range bound market can be identified by horizontal upper resistance and horizontal lower support of price zones.

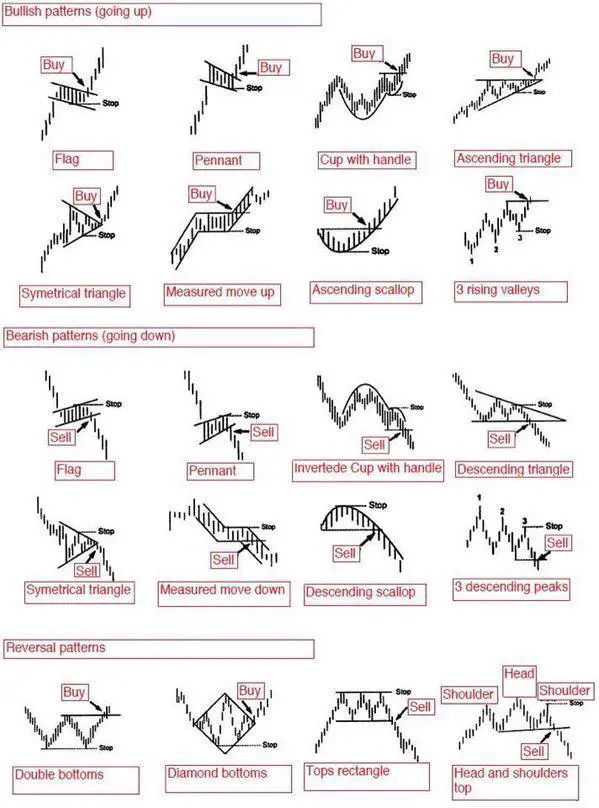

A momentum trader can use breakouts of key vertical support or resistance trend lines as pure price action breakout signals in chart patterns. Chart patterns can signal breakouts, reversals, and continuations using only current price action.

The legendary turtle traders used pure price action systems to trend trade the markets for millions in profits. The Turtles traded a Donchian breakout system. System 1 entered a 20 day breakout in the price range and exited when there was a 10 day break out in the opposite direction of the entry. System 2 entered a 55 day breakout in the price range and exited when there was a 20 day break out in the opposite direction of the entry.

Pure price action can be used to create entry and exit signals, trailing stop losses, and profit targets with no other indicators needed. The key is to use price action to create good risk/reward ratios on entry when you contrast your stop loss with your profit target and then manage the trade to minimize losses and maximize gains over and over again.