The broken wing butterfly is an option play that is also called a skip strike butterfly and can be constructed with calls or puts. It is an adjustment to a conventional butterfly option play.

This strategy using call options consists of embedding a short call option spread inside of a long call butterfly spread. An option trader is selling a short call spread to lower the cost basis for the butterfly play. Since creating those call option spreads individually would require both buying and selling a call at strike C in the example below, they nullify each other resulting in a dead strike inside the conventional butterfly play structure.

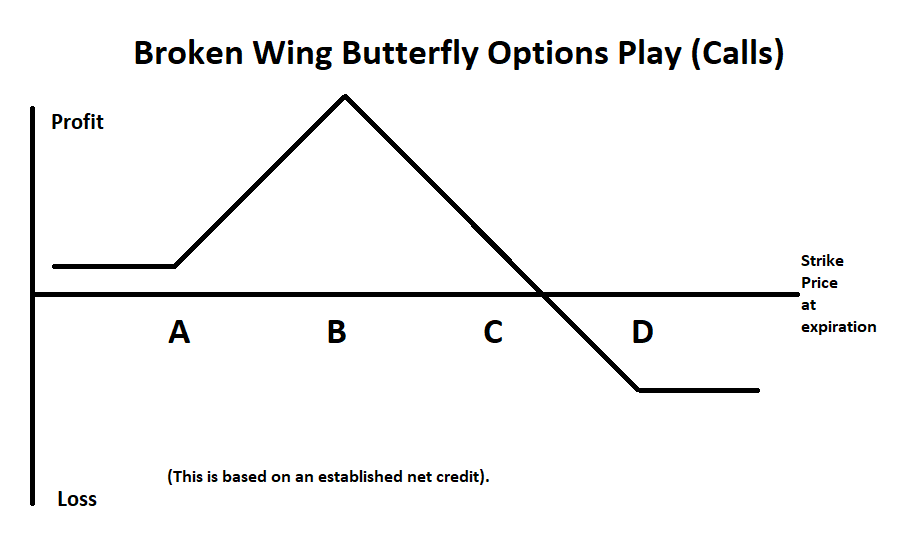

Broken wing butterfly option play structure:

- Open this play when the stock is near strike A.

- Strike price A: Long call option.

- Strike price B: Sell two call options short.

- Strike price C: Skip over.

- Strike price D: Long call option.

- Strike prices are for the same month expiration and are equidistant.

This option play is used by a mildly bullish trader. An option trader would want the underlying stock to move to strike B and stop around that area.

If a broken wing butterfly is opened for a net credit the the break-even price level is located at strike C with the net credit received when establishing the strategy.

If a broken wing butterfly is opened for a net debit there are two possible break-even price levels:

- Strike A with the net debit cost.

- Strike C minus the net debit cost.

Maximum profit is capped to strike B minus strike A minus the net debit paid, or plus the net credit received.

Risk is capped to the difference between strike C and strike D minus the net credit received or plus the net debit paid.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.