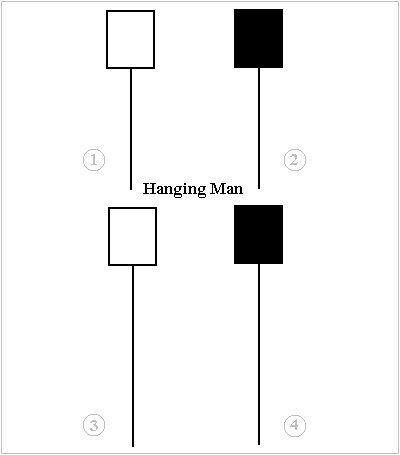

A hanging man is one kind of bearish reversal candlestick pattern. The hanging man is the name of a signal candle that is located inside an uptrend of higher highs and higher lows in price on a chart.

The hanging man candle has a lower wick (shadow) that is longer than the body which is usually much shorter and flat at the top with little or no upper wick (shadow). The long lower wick expresses the wide intra-day trading range and volatility and the smaller body shows the open and closing prices were close to each other. Most traders believe that the lower wick must be at least twice the size of the body to be a valid hanging man and the body must occur at the top of the daily trading range.

A hanging man candle appearing during an uptrend increases the odds of a reversal happening and the chart turning to the downside or sideways. Some people use the hanging man as a signal in itself but the probabilities of success are better if it happens at the same time as other technical indicators like previous price resistance or an overbought reading on the chart.

It can be visual evidence that buyers are losing the ability to hold price higher and that sentiment is starting to change. It can show that the momentum of an uptrend is starting to wane.

A hanging man shows the buyers losing the battle to hold prices higher. Even with buyers managing to bid prices back up by the close there was selling pressure that dragged prices much lower intra-day. This candle shows the first stage of selling pressure during an uptrend. For traders that focus on candlestick signals they may lock in their profits or even sell short after this pattern forms. Many times it can be a warning sign for current long positions.

This candlestick pattern is called a hanging man only when it appears in uptrends, it is bearish, and is confirmed by the next candle making a lower high and lower low.

The same visual pattern forming during a downtrend is called a hammer candlestick and is bullish in the context of a chart in a downtrend as it shows a rejection of new lows.

Altafqadir at English Wikipedia / CC BY (https://creativecommons.org/licenses/by/3.0)