A trailing stop loss is a risk management tool for locking in profits on a winning trade. While a trade may start out with a stop loss after the initial entry to exit if the trade does not go in the right direction but instead goes low enough to show that a trade is wrong.

While a stop loss is a way to manage a losing trade a trailing stop is way to manage a winning trade. The purpose of a stop loss is to keep a loss small while a trailing stop is a way to make a winning trade as big as possible.

An initial profit target on entry is one way to measure the risk/reward ratio on a trade when compared to the stop loss placement but a trailing stop can maximize a gain allowing a trend to run as far as it will go.

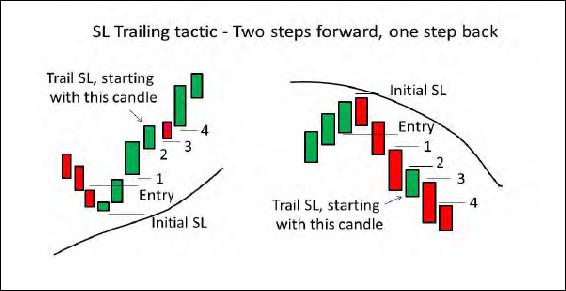

While a stop loss is set to cap a loss a trailing stop is moving to maximize a gain. A trailing stop is an exit strategy that triggers a stop when a price reverses back enough to signal the possibility that a trend is possibly coming to an end.

A trailing stop is a quantified strategy to keep a trader in a trend until the end when it starts to bend.

Here are some key strategies for trailing stops.

- Use a short term moving average as a trailing stop in a swing trade. Exit when the price closes below the chosen moving average.

- Use a long term moving average as a trailing stop in a trend trade. Exit when the price closes below the chosen moving average.

- Exit a winning trade when price closes below the previous day’s lowest price.

- Exit a trade when price closes under a specific RSI reading like 30 or 50.

- Exit after a bearish candle like a bearish engulfing.

- Use a close below a price support level of a current trading range.

- Exit on a close below the last gap up day low.

- Use a lowest price in a set number of days as a trailing stop. For example enter on the highest price in 10 days and exit if it returns to the lowest price in 5 days.

- Exit if price retraces a percentage from its highest price.

- Exit on a retracement of a percentage of a move in price.

These are all different strategies and can be used in different situations or in tiers to manage the exit of a winning trade. Money is only made on the exit not the entry and managing a trade for maximum profits is one of the most important skills a trader can learn.