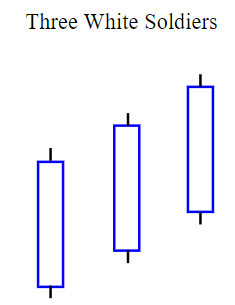

The three white soldiers is a very bullish chart pattern that is created with candlesticks when there are three big candles formed in a row with higher highs and higher lows in a row. This pattern needs three data points across a timeframe to signal momentum and a high probability that a market will shift in an uptrend from rangbound or a downtrend if that was the price action behavior before this pattern.

This candlestick pattern looks like a staircase with each open above the the previous day’s open and the next candle holding at least the middle price range of the previous day. Each candle in this pattern should also create a new higher high than the previous candle.

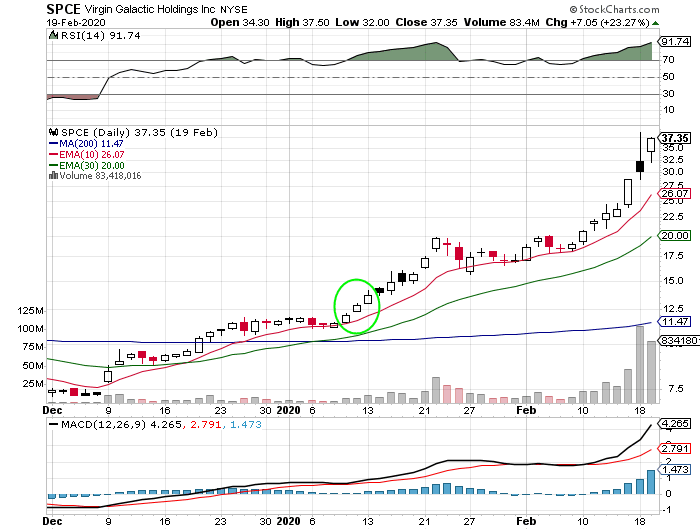

The three white soldiers is a strong confirmation for any other bullish signals that the market has shifted to a bullish uptrend, it works the best with a confluence of other momentum signals like moving averages, breakouts, or the MACD crossover.

The danger of this pattern not working increases if the strong moves takes a chart into an overbought reading like a 70 RSI. The odds of it working increases if the move happens off oversold support near the 30 RSI.

It is primarily used as a reversal signal out of a downtrend or a bear market as that creates the best risk/reward ratio.

“This type of price action is very bullish and should never be ignored.” – Gregory L. Morris

The inverse of the The White Soldiers bullish momentum signal is the bearish reversal signal Three Black Crows that is the reverse: three strong black candles to the downside with lower lows and lower highs.