A risk reversal option strategy play is a position that is constructed by selling short an out-of-the-money put options and also buying long an out-of-the-money call option that both have the same expiration date.

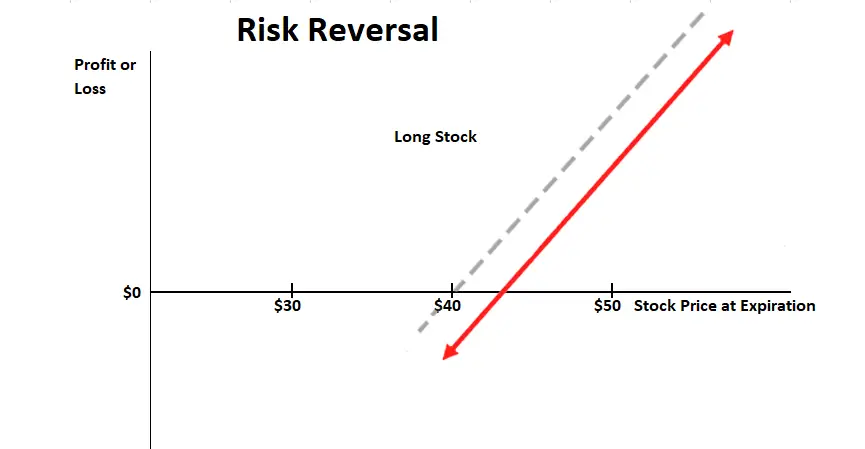

The risk reversal option play simulates approximately the profit and loss of owning the underlying asset, it is also called a synthetic long. This is an option strategy that both buys and sells two out-of-money options at the same time to construct the same risk/reward dynamics of a long position but using less capital.

With this strategy the option trader first needs a signal to go long before constructing this type of position as it has a bullish bias for profits. Instead of going long on the stock, currency, or commodity the option trader will instead use the long call and short put to mimic a similar way to both capture an upside move or risk losing a drop in price as the options move.

The option trader uses the capital from the sale of the short put option to buy the call option. Then if the underlying asset moves higher in price, the call option will increase in value while the put option will go down in value very similar to being long the underlying asset itself.

Unlike a stock position a synthetic long position like a risk reversal is only valid until the options expiration date.

Red line markets the similarity between a risk reversal option play behavior versus a long stock position.

You can also check out my full Options 101 eCourse at NewTraderUniversity.com.