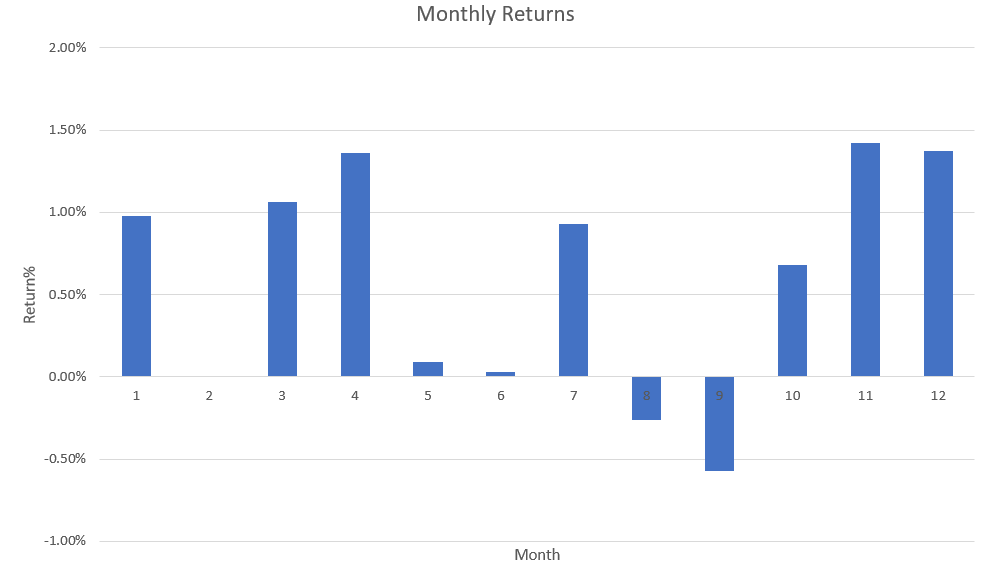

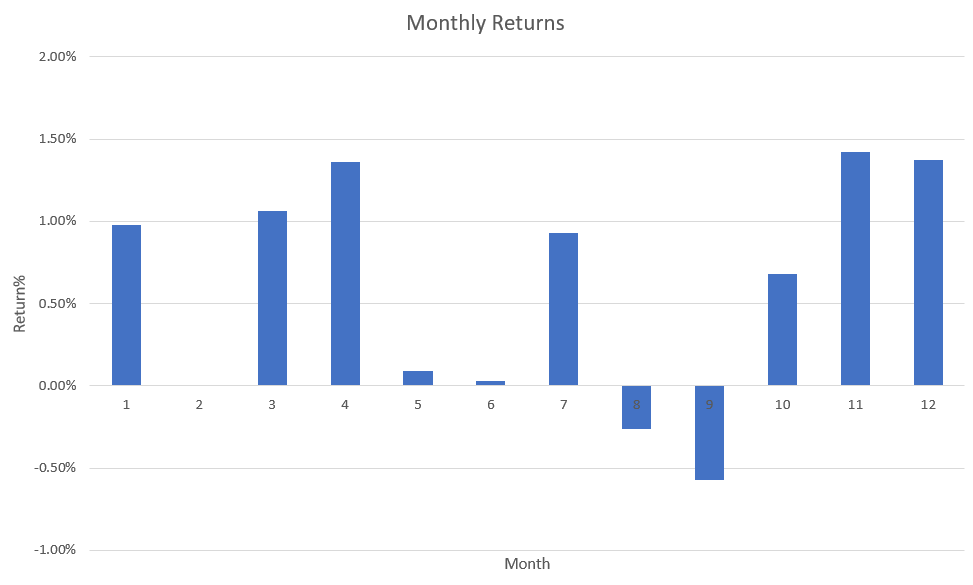

Have you ever been curious if certain months of the year have any statistically significant stock market returns better or worse on average than other months.

Here are the statistics for monthly S&P 500 index performance from 1950 to 2019 to let you see if you see any patterns.

Month: Number of times with positive returns; number of times with negative returns = Average return.

- January: 42 up years; 28 down years; average return = +0.98%

- February: 40 up years; 30 down years; average return = 0.00%

- March: 44 up years; 26 down years; average return = +1.06%

- April: 49 up years; 21 down years; average return = +1.36%

- May: 41 up years; 29 down years; average return = +0.09%

- June: 36 up years; 34 down years; average return = +0.03%

- July: 40 up years; 30 down years; average return = +0.93%

- August: 38 up years; 32 down years; average return = -0.26%

- September: 32 up years; 38 down years; average return = -0.57%

- October: 43 up years; 27 down years; average return = +0.68%

- November: 47 up years; 23 down years; average return = +1.42%

- December: 52 up years; 18 down years; average return = +1.37%

The long term trend in the S&P 500 index is up but many months historical have zero returns over the past 70 years. Interesting that April, November, and December are statistically very bullish times while August and September are bearish on average for stocks. You can really see why there is the old saying: “Sell in May and go away.” and October through April is where the bulk of stock market returns come from historically.