Is technical analysis bullshit?

Is technical analysis bullshit?

Many people will dismiss technical analysis as useless before doing the homework to even fully understand what it is or how it should be used. Dismissing technical analysis as bullshit after hearing that academics dismissed it in a paper is like saying no one can make any money in the stock market because some academics did a study and didn’t make any money.

There are as many ways to use technical analysis as there are ways to make money in the stock market. Stock market participants range from day traders to value investors from option traders to futures traders and technical analysis is just as diverse. It is the peak of arrogance for someone to think they can dismiss the entire art and science of technical analysis because they can’t figure out how it works or how to make it work. Many traders spend thousands of hours to construct profitable trading strategies using some form of technical analysis.

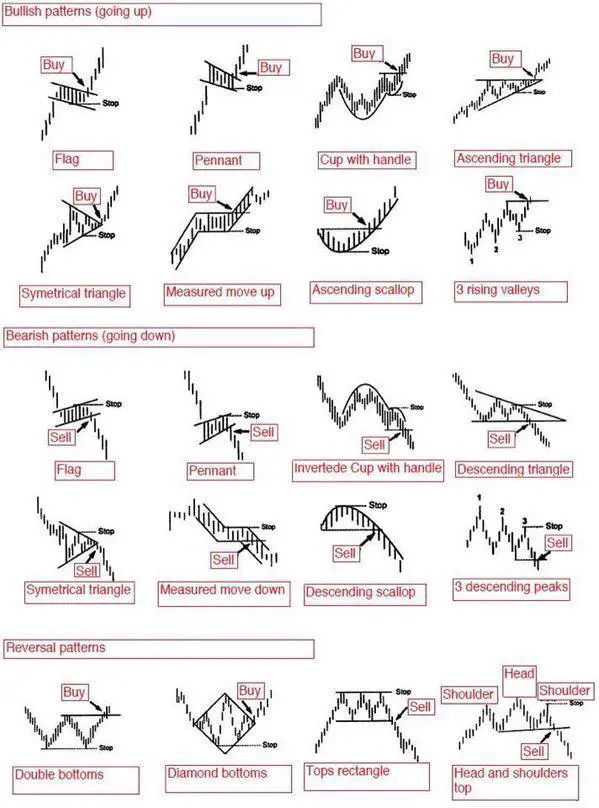

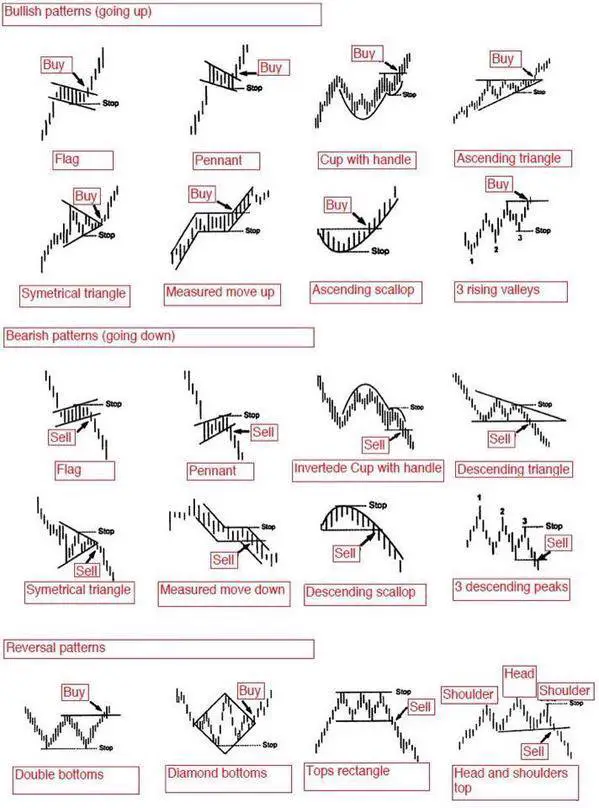

There is predictive technical analysis that tries to tell what the future will be from the present chart pattern and then there is reactive technical analysis that tries to go with the flow of current price action in the path of least resistance and stay with the trend. One looks at chart patterns as crystal balls and the other looks at a chart like a traffic light.

The right question is not “Does technical analysis work?” or “Is technical analysis BS?” but to first quantify and specify what exactly do you think technical analysis is? What patterns are you testing? What time frame? How are you managing the entries and exits? What is your position sizing? How diversified is your watchlist going to be and how many positions will you take? How will you account for volatility?

The real search for profitable trading is creating a positive expectancy model and technical analysis is just a tool for finding it in repeating patterns. Technical analysis is the tree and the trading system is the forest. Many miss the forest for the trees.

Most of the people that dismiss technical analysis have no idea how to even create a technical trading system to backtest or forward test much less have enough information to dismiss it as not working at all.

Also they never seem to research the millionaire traders that have proven that it gives them a profitable edge in the markets. It is as if they said you can’t make any money playing football because they tried and it didn’t work for them.

Technical analysis is the art and science of using the behaviors seen on a price chart of traders and investors as they interact buying and selling a stock to create good risk/reward ratios for entry signals. Profitable trading using technical analysis is based on quantifying trade entries and exits with a good probability that losses will be small and wins would be big. By placing stop losses at price levels that will prove you wrong and letting winners run until price reverses and tells you the move could be ending. That is the proper use of technical analysis everything else is just commentary.

Just like there are millionaire football players there are millionaires that used technical analysis to make a lot of money. In Jack Schwager’s books he interviewed several of these traders with long track records. Even billionaire Paul Tudor Jones was seen using Elliott Wave technical analysis in the ‘The Trader’ documentary on PBS before doubling his money under management in the October 1987 Black Monday plunge.

Here is a famous quote from a billionaire investor. “I haven’t met a rich technician” – Jim Rogers

Well Mr. Rogers, let me introduce you to billionaire Paul Tudor Jones and multi-millionaire Marty Schwartz just a few of many rich technicians over the last 100 years including Nicolas Darvas, William J. O’Neill, Jesse Stine, Dan Zanger, and many others.

“Elliott Wave theory allows one to create incredibly favorable risk/reward opportunities. That is the same reason I attribute a lot of my own success to the Elliott Wave approach.” – Paul Tudor Jones (Market Wizards)

“I always laugh at people who say “I’ve never met a rich technician” I love that it’s such an arrogant, nonsensical response. I used fundamentals for 9 years and got rich as a technician” – Marty Schwartz

Marty ‘the Pit Bull’ Schwartz; the best technical day trader in the world. Mr. Marty Schwartz run his account up from $40,000 to $20 million by trading.

Like so many things success in technical analysis is based on the work you put into it. What is BS for some creates wealth for others. It all starts with a belief, if you don’t think it will work then it definitely will not work for you.