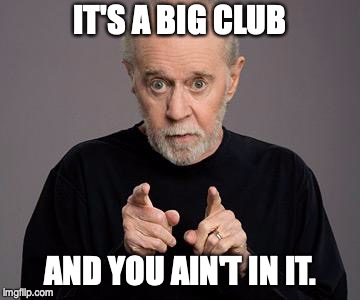

“It’s a big club, and you ain’t in it.” – George Carlin

The long term trend of the stock market is up. Not individual stocks, as some go up 1,000% and others go to $0 over the years. However, equities as an asset class tend to go higher over five and ten year periods most the time. Wait twenty years and you are sure to make a lot of money as a perma-bull buy and hold investor, a dip buyer, or a trend following trader. The best way for an investor to participate is to buy a stock index as they will naturally bring in winning stocks and kick out the losing ones. Stock traders will usually have a much easier time being profitable over the long term with bull signals.

Now with that said there is a big industry in perma-bears, they constantly call for the collapse of the financial system. They shout that national debts are unmanageable and will lead to defaults, the currencies are not backed by anything and will go to zero, and that we are always on the verge of a second great depression if not a collapse of civilization itself. They waste blog articles writing thousands of words about bearish chart patterns, Hindenburg Omen signals, and death crosses leading to the next market crash only to see new index all time highs play out eventually.

After all their warnings for the past twelve years and for many much longer than that we have had a dotcom bubble, a financial crises, and a worldwide pandemic that all lasted for less than two years and bull markets that have lasted for 8 years of more. Bear markets are small and bull markets are huge. A short position can only make a 100% return if a stock goes to $0 but a long position in the right stock can go up 1000%, the math of negativity just doesn’t work over the long term.

There is a club that ensures that equities as an asset class continue to make new all time highs.

- The politicians want high stock prices for votes as it plays well with voters that are investors in retirement funds.

- Central banks are motivated to keep stock markets stable to avoid political backlash.

- As currencies are devalued stocks go up in value as their earnings rise as their products cost more. Stocks can be a hedge for inflation.

- The CEOs of publicly traded companies are incentivized to grow share price for their own career and possible stock options.

- Corporate boards purpose is to grow shareholder value.

- If all else fails the company will just buy back their stock to lower the share count float and supply.

- The regular monthly contributions to mutual funds in retirement accounts create inflows of buyers.

- New companies go public as founders want to fully monetize their companies and create an exit strategy for early investors.

- The government can always step in and bail out a company if they are well connected politically.

- The monetary policy of low interest rates forces capital to go looking for some type of return in the equity market.

Bears may win an occasional battle but bulls win wars. The bears are fighting a losing battle.

If you are are a perma-bear on the stock market and endlessly believe the markets will crash, well then, it’s a big club and you ain’t in it.