What is Positive Expectancy?

The closest a trader can hope to come to a “Holy Grail” of profitable trading is a trading system with a positive expectancy. A trader’s focus should not be on predictions, stock picking, opinions, or being right all the time. The best focus is on creating a quantified system with an edge that is repeatable that creates small wins, big wins, and small losses that average out to profitability over time. A positive expectancy means that when you average out all the wins and losses you make money. It means if you divide your total profits by your total trades and have a positive outcome on average. You expect that if you place a certain amount of trades that you will be profitable at the end of the sequence of entries and exits.

Positive expectancy could be the most important part of your trading. For every trader no matter what trading method they use on any timeframe, if they don’t have a positive expectancy trading model then they have no edge and will likely have no long term profits. Before traders start putting any money at risk they should know if the trading system they are using has a positive expectancy. Without first having a positive expectancy system to trade that fits your own risk tolerance and return goals your trading psychology and risk management don’t matter. If you use good position sizing and the right mindset on trading a system with a negative expectancy or high risk of ruin it just means you lose money slower.

Knowing we have a positive expectancy means we have done enough homework, backtesting, and validation to show ourselves our trading system will create profits over the long term based on our signals, win rate, and risk/reward ratio. The first part of successful trading is in the research to validate your system. This is a lot of work and effort and why most traders don’t make it as they want easy money not to do hundreds of hours of work. The win rate is not what created a positive expectancy it is the size of all the wins and losses combined that create the expectancy. You can have a low win rate system that is profitable due to a few huge wins and a lot of small losses. Big losses are the primary factor that creates a negative expectancy system. The first step to creating a positive expectancy system is removing big losses from your system and the second most important is to let your winners run. This is the job of your entry signals, exit signals, position sizing, trailing stops, and profit targets, to create small losses or big wins.

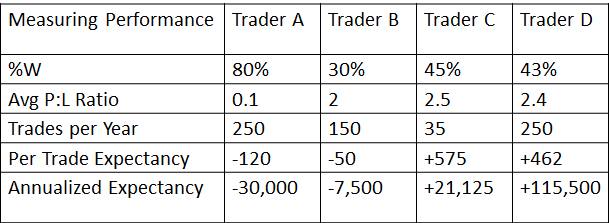

So how can you calculate a trading system’s positive expectancy?

E(R) = (PW x AW) – (PL x AL)

where;

E(R): Expectancy/ or Expected Return

PW: Probability of winning

AW: Average win

PL: Probability of losing

AL: Average loss

Positive Expectancy: is a positive “E(R)”

This is the first step in a new trader’s journey not something they do later. A lot of positive expectancy emerges from trade management after a trade entry with stops to minimize losses and trailing stops to maximize gains.