Selling short reverses the process of buying and selling higher. When selling short you borrow shares and sell first hoping to buy back later at a lower price for a profit. Selling short goes against the long term trend in the stock market and has to be done when charts create the best chances that they are ready to reverse and go lower.

Selling short reverses the process of buying and selling higher. When selling short you borrow shares and sell first hoping to buy back later at a lower price for a profit. Selling short goes against the long term trend in the stock market and has to be done when charts create the best chances that they are ready to reverse and go lower.

Here are the best five setups for selling a stock or market short.

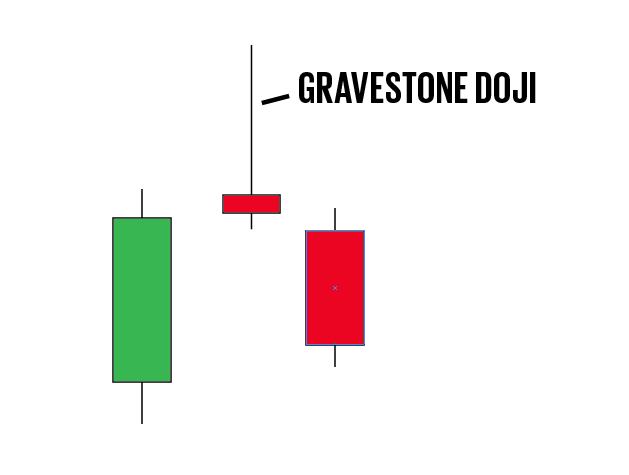

Selling short when there is a follow through to the downside on a bearish candle after a gravestone doji. This shows that the chart has run out of buyers at higher prices and is reversing.

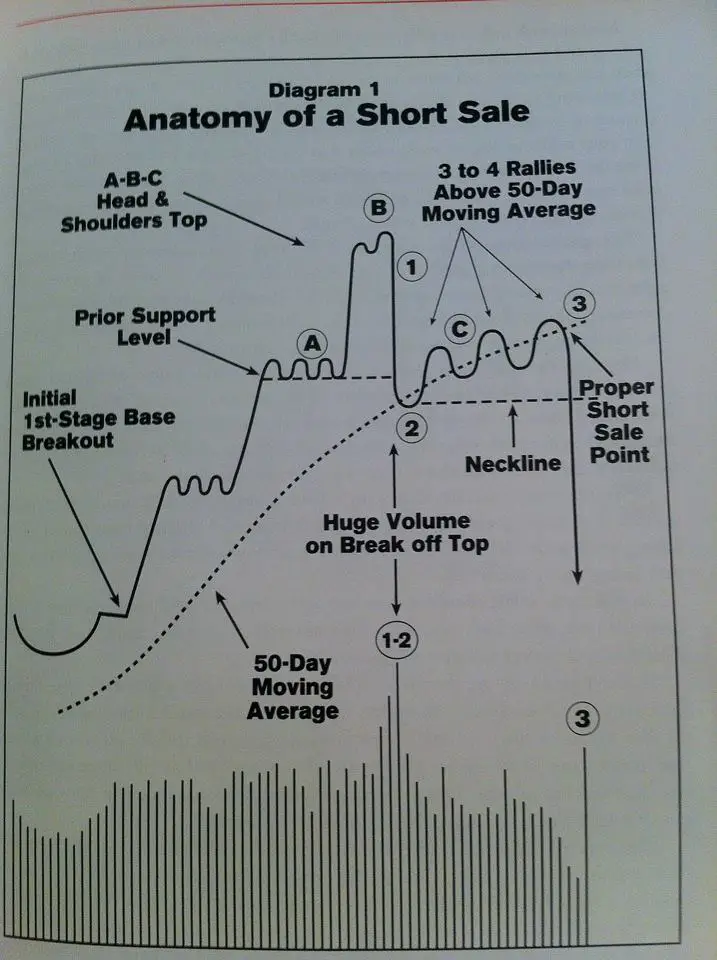

Selling short a stock after a bearish head and shoulders chart pattern and breakdown under the right shoulder.

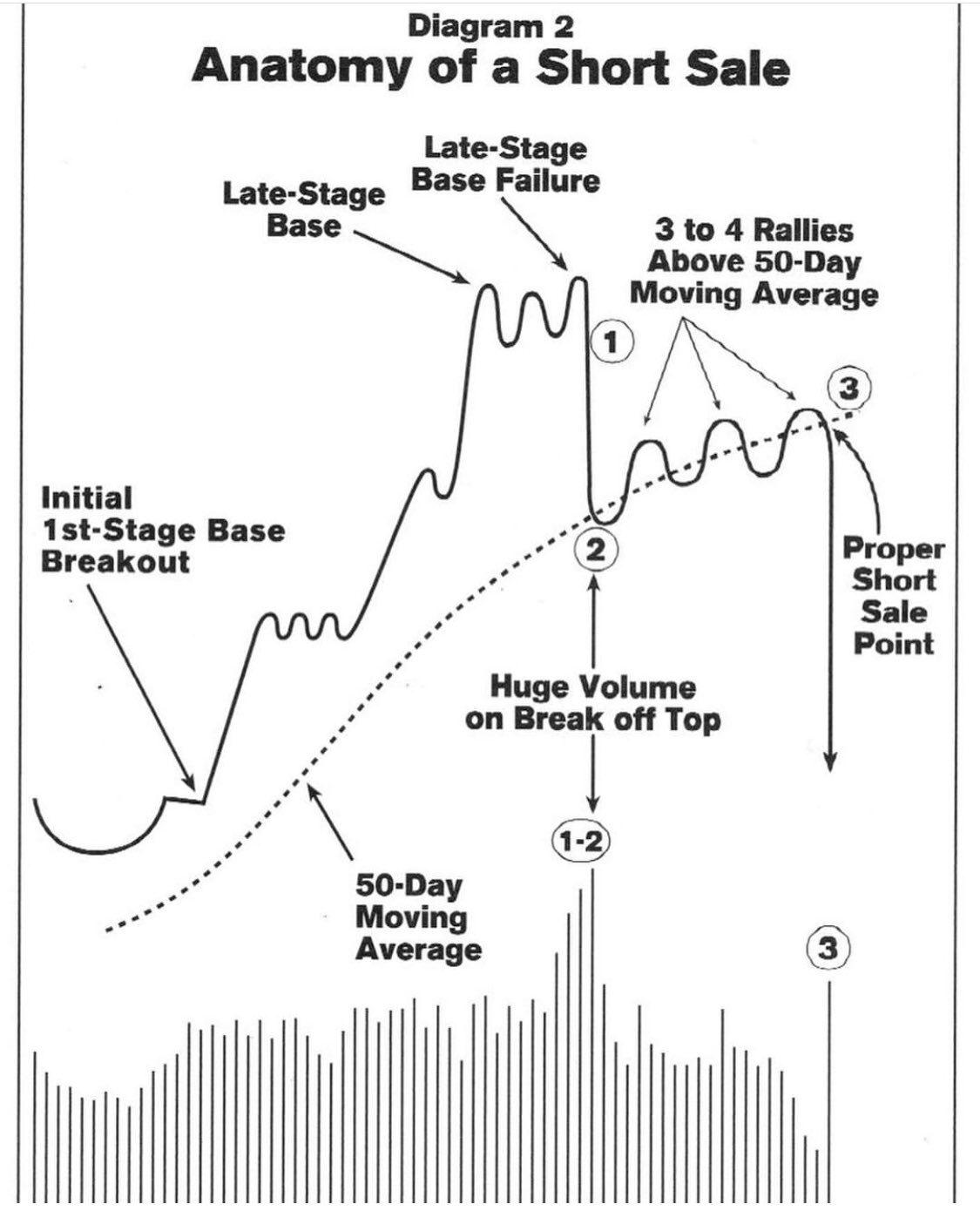

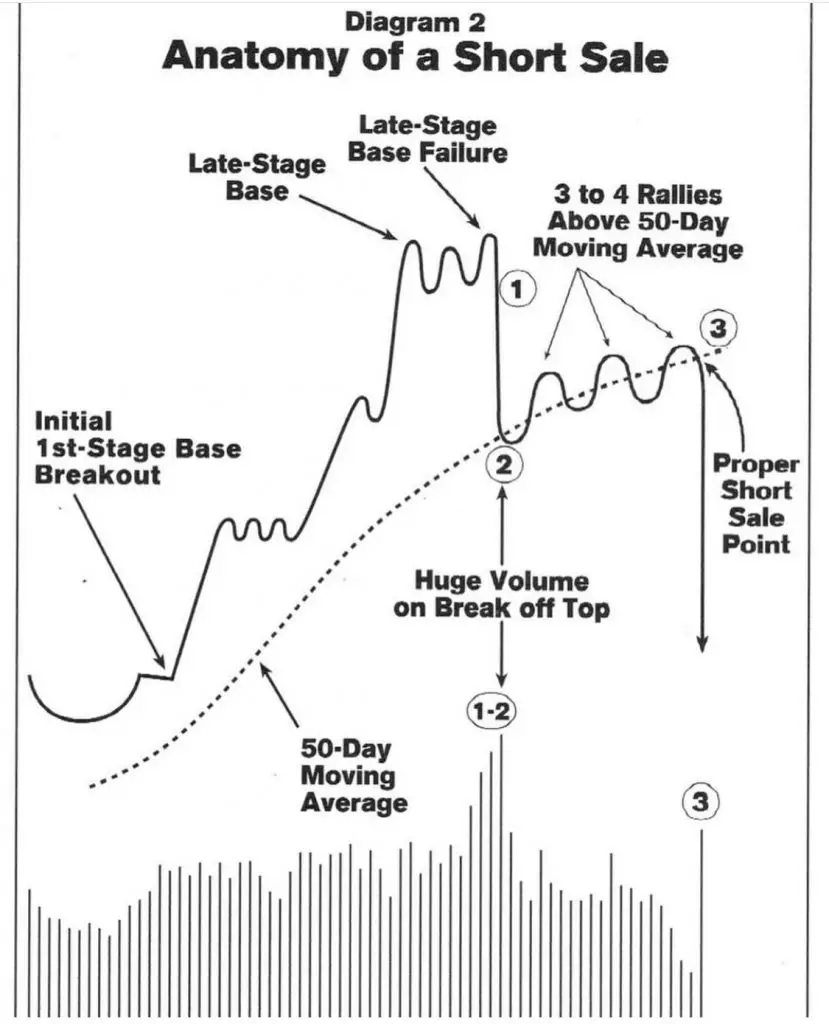

Selling short a stock after the loss of the 50 day moving average with the failure of a late stage price base.

Selling short a bearish double top chart pattern after the key support level in the pattern is lost.

Above chart diagrams are from the book: How to Make Money Selling Stocks Short.

Chart courtesy of StockCharts.com

Selling short the loss of the long term 200 day simple moving average on a chart.

Chart courtesy of TrendSpider.com

These are just some of the best short selling setups, you still must manage the trade for the opportunity for profitability. Trade management consists of a stop loss to keep a loss small if the chart reverses higher near the time of entry, a trailing stop will help maximize a winning trade if it keeps going lower, and a plan for locking in profits when a profit target is met or an exit signal is triggered in price or time.