Theta is the component inside the options pricing model that measures and values the sensitivity of an option contract price in correlation to the passage of time. The theta value embedded in an option depends on the price of a specific option contract in relation to its expiration date, the current price of the underlying stock and the strike price.

Time decay is the loss of extrinsic value an option experiences as it approaches expiration. The speed of this loss of theta value excellerates as the option gets closer to expiration. The farther out-of-the-money an option is the more the option price is derived from theta value.

The mathematical formula for theta is shown in value per year.

It is common to divide the result by the number of days in a given year, to calculate the amount an option’s price will fall in correlation to the underlying stock’s price. Theta is usually negative for long calls and long puts, and a positive for short calls and short puts. The total theta amount for all options in a trading account can be calculated by adding up the thetas for each individual option position.

The price of an option is calculated in two ways: the intrinsic value and the extrinsic value. The intrinsic value is how in-the-money and option is and how much it is worth if exercised now. A $100 strike in-the-money call option on a stock priced at $105 has $5 in intrinsic value. A $110 strike out-the-money call option on a stock priced at $105 would have $0 in intrinsic value.

The extrinsic value of an option is the cost of having the option while holding it with the opportunity of it being in-the-money at the time of exercise. A deep out-of-the-money option will be worth extrinsic theta value as there is a probability that the stock price will go in-the-money before the expiration date. As time gets closer to expiration the probability of the option going in-the-money drops faster and faster so the theta value drops as the time is spent.

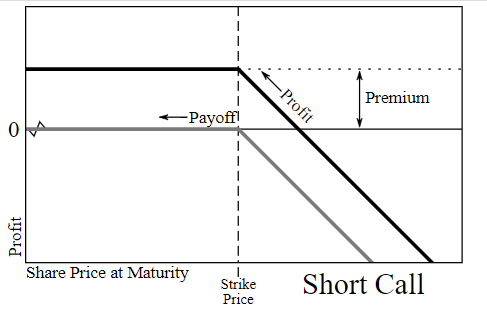

If you are net long options have negative theta and your option plays will go down in value with the passage of time if other factors like vega stay the same. If you are net short options you have positive theta and your option plays will go up in profit with the passage of time if other factors like vega stay the same.

Time decay works against you when you’re long an option as expiration approaches. Time decay works in your favor when you’re short an option as your play goes up in value as expiration moves closer.

An option must increase more in intrinsic value by going in-the-money than it loses in extrinsic time value to be profitable to an option buyer at any given time during the option trade. For an option seller to make money the option must lose more in time value than it gains in intrinsic value before the option is purchased back to close or expires worthless to be profitable.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.