Order flow is the process of buyers and sellers trading between one another that causes market prices to stay the same or move up and down. Zooming in on order flow it is the volume bars along with the time and sales information of trades. Order flow is where buyers and sellers meet at an agreed upon price and transact at the bid and ask prices. It’s where a trend or price range develops in a market as the sell orders at a price level overtake the buy orders and create a move down in price, or the buy orders are greater than the supply of sellers at a specific price level and the market moves higher. Buyers and sellers are always equal in trades it is the price that moves if there is an imbalance to a new price level where transactions can take place. Price changes with the order flow of bids and asks at different prices based on where the buyers and sellers are in price agreement.

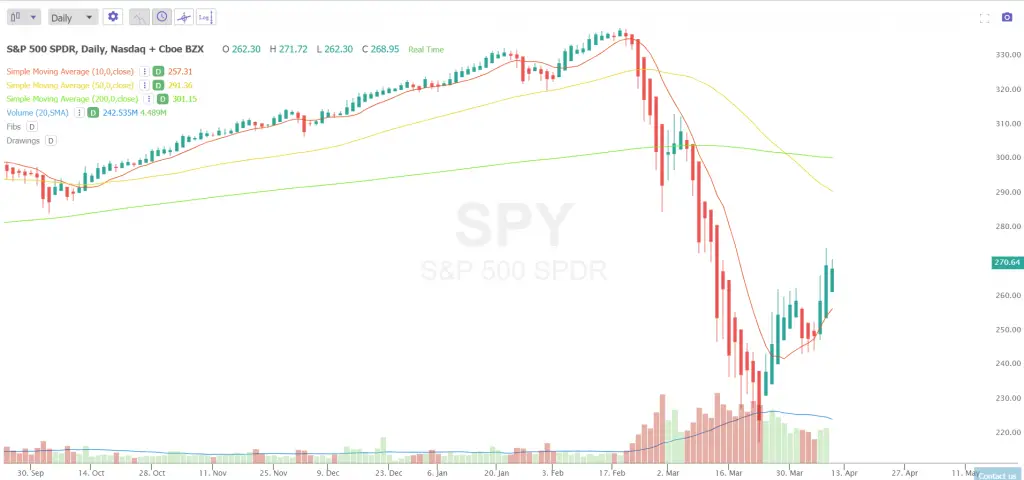

Zooming out for a wider view price action is the visual pattern that is displayed on a chart over a time frame due to the order flow of trades. Price action is the map that shows the flow of money. The price action you see on your charts gives clues for which direction that the market trend is likely to continue to go next. The best odds is in the direction of least resistance.

The current quoted price in a market is the value that the market participants agree on right now, it is where the bid and ask price meet to create a real time trade. When new information like economic news, earnings, sales, company changes, or monetary policy is known by traders and investors, then participants buy or sell based on their personal expectations of making or losing money. This new sentiment can change prices to new levels to reflect the new information as positions are adjusted.

Trading a rule based system based on reacting to price action patterns that emerge from the order flow gives traders a much better chance of success than relying on their own predictions, opinions, or listening to talking heads.

Flexibly following what is happening versus what you think will happen is how you trade order flow and price action.