In option trading a straddle play is created when two option trades are opened in the same underlying asset at the same strike price at the same expiration date but with both a call and a put. One side of the option play will become higher priced in an uptrend and the other will move higher on a downtrend.

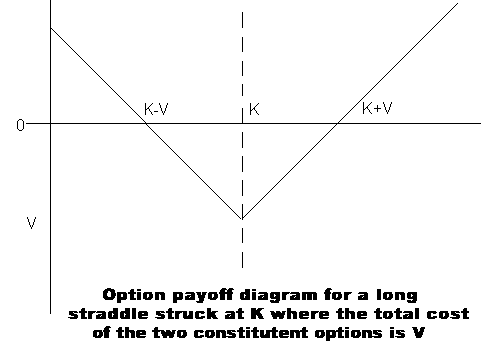

A long straddle option play is created by buying a call option and a put option with the same strike price and date of expiration. If the price of the underlier remains too close to the strike price of the straddle at the expiration of the options then the straddle will lead to a net loss as it takes a strong trend to make the straddle profitable as theta decreases the value of both long options over time.

If there is a big enough trend in either direction then it is possible for a profit as the option on the winning side will have a large enough price expansion by going in-the-money to pay of the losing side. A long straddle is the right play for an option trader when they are expecting a large move in a market in either direction but want to bet on either playing out and set risk at the price of the option contract.

A long straddle option play is structured to profit in either direction the market takes if the price movement is at a big enough magnitude that the winning side option contract gains enough to offset the losing side option contract.

Long straddles have a better chance of success when volatility is under priced and a market moving event is unexpected. It is direction neutral but long the potential of a strong trend in the timeframe of the option before expiration.

Long straddles are very expensive to play on a stock through earnings as the historical volatility is priced in and the vega value will be priced out after earnings and must be replaced with intrinsic value after the earnings announcement to be profitable.

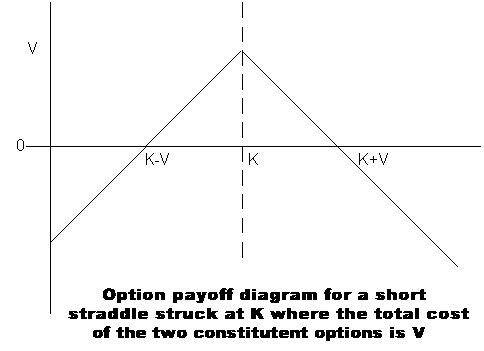

A short straddle is a non-directional option play when the trader sells a put option and a call option on the same underlier with the same strike price and expiration date. The potential profit is capped at the total option premium the option writer receives from the sale to open the transaction from the put and call price at the sale.

The risk of a short straddle play is theoretically unlimited as a large trend in the underlier price whether up or down will create a large loss. If a price move causes one side of the short straddle play to go in-the-money and cost more to buy back than the total premium received when it was opened it will become unprofitable.

The most profit possible for a short straddle happens at expiration if the underlying asset trades at the same price as the strike of the straddle. If both the put and call sides of the straddle expire out-of-the-money and worthless the straddle achieves the maximum profit and the option trader profits from all the premium received when the play was opened.

The short straddle option play is nondirectional because the short straddle profits when there is no trend in price during the time the play is open. The short straddle can be considered as a credit spread because the short straddle is sold to open and results in a credit from the option premiums of both the put option and call option.

The risk for the option trader of a short straddle play is potentially unlimited due to having no hedges in place while being short both sides of the market with both a call and a put, of course a stop can be used to buy to close and stop losses if the market goes against one of your positions. While the winrate with the short straddle play can be high the risk/reward ratio is not good as the maximum profit is limited to the premium of the options received but a loss can be any size if the play is held during a strong trend.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.