An Iron Condor trading strategy is an option play that is created with two vertical spreads. An Iron Condor is a combination of both a put option spread and a call option spread that have the same expiration date and four different strike prices.

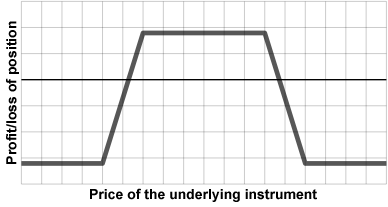

A long iron condor is when an option trader sells both sides of the underlying stock or commodity by shorting the same number of calls and puts at the same time, then buying another option contract further out of the money of each position to hedge with the purchase of calls and puts.

By Mkoistinen (talk) – self-made, Public Domain, https://en.wikipedia.org/w/index.php?curid=17576288

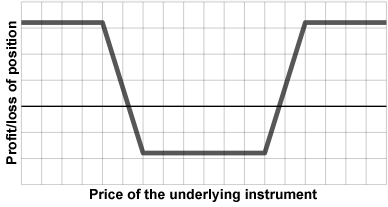

A short iron condor is when an option trader buys both sides of the underlying stock or commodity by going long the same number of calls and puts at the same time, then selling other option contracts further out of the money from each position to reduce the cost with the sell of calls and puts.

Mkoistinen / Public domain

This option play is named for the shape of the potential for profit and loss graph, which looks similar to a large bird with a body and extended wings like a condor. With this analogy option traders often call the closer options the ‘body’ and the farther out options the ‘wings’. It is called ‘iron’ to denote its strength in being profitable inside a set price range.

One edge of an iron condor play over a single vertical spread is the initial and maintenance margin needed for the open iron condor is often the same as the margin for one vertical spread as the risk can only go against one side at a time. However the iron condor offers the chance to profit from two net credit premiums of options instead of just one. This can create a larger return on capital at risk when the market is in a trading range.

An edge an iron condor has with commissions happens when the price of the underlier is trading inside the price range of the options inner strikes at expiration and a trader can let most or all of the options expire worthless with no need for further trading costs.

An option trader can also close a leg of the trade if price moves within range of going in-the-money on a short side of an option.

The danger for long iron condors is during market trends in one direction during the time of the trade causing a loss on the short options or if the options in the play becoming illiquid and difficult to exit without losing a large amount in the bid/ask spread. The parameters set when you open the trade can set your risk based on the worse case scenario of price reaching your hedges for the maximum loss.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.