The Maximum Pain theory in the options market or simply ‘Max pain’ tries to explain that market prices for stocks and commodities will many times settle at the approximate price on the option expiration date where the most option buyers will end up losing the maximum amount of money.

The Max Pain is always the approximate current strike price with the most open contracts of dollar value of puts and calls on either side of the price that would expire out-of-the-money and worthless causing the most loss of capital for the largest number of option holders still long at expiration according to open interest.

Except for a very few traders who are using in-the-money options to enter or exit a stock, most other options traders usually exit their in-the-money options prior to expiration day.

For example if you own a stock and an in-the-money put option, you may allow it to exercise at expiration, putting some of your loss onto the option seller. If you are holding an in-the-money call option, there is rarely is any advantage to closing the trade before expiration if you want to own the stock, because the call option, having lost all of its time value, gives you all of the profit of the stock without all the risk. The same is true, in reverse, for short options.

If you have an in-the-money naked put option near the expiration date, having lost all its time value, there isn’t any advantage over shorting the stock, but there is a big disadvantage – your profit is capped. the only reason to keep a naked put open very near expiration is because I want the underlying shares put on me at a known price, for example, if I am short the stock. My risk on the short stock is unlimited but my profit on the in-the-money naked put is not – that’s not good risk management in most cases, but unfortunately sometimes necessary if options liquidity is poor. Even then, liquidity is only a problem if the option is traded, not if it’s exercised, so really, the only folks left are those without sufficient capital to perform the exercise, or those who are asleep. Same for a naked call and long stock – unlimited risk on the stock, limited gain on the option – not a good mix unless it cannot be avoided due to liquidity or insufficient capital or a strong cup of coffee.

Taking the disadvantages of in-the-money options into account, it is normal for open interest to decrease for those options, leaving only at-the-money and out-of-the-money options open. Of the remaining open interest, some traders may be using those options as a hedge, for example for gamma hedging, but it is unlikely that gamma hedgers would have a huge influence in the stock price, especially since gamma hedging tends to work best when options have gamma potential, which they don’t have much of near expiration at out-of-the-money strikes.

The end result is that the stock will almost always close at a price that is in-between the greatest amount of open interest, so that the most options expire worthless, but not because it gives those worthless option holders max. pain (it also gives the option sellers maximum profit, after all) but simply because those options are leftover waste products, no longer needed by traders, and the ones that were useful have already been used up.

The Max Pain theory doesn’t show that buying options is necessarily unprofitable and there is an edge in selling options as the majority of options are traded back and forth and not just held until expiration. They could have been closed for a loss or a gain before expiration. A common misunderstanding among new option traders is that 90% of all options expire as worthless, so a seller of option premiums will have a higher win rate than a trader that buys options. This belief doesn’t take into account a statistic published by the Chicago Board Options Exchange (CBOE) that only 10% of option contracts are actually held until expiration and then exercised. 90% are bought back and closed before expiration so they are removed from the ‘expired for a loss’ statistic.

Even with 10% of option contracts being held and exercised doesn’t automatically mean the other 90% expire worthless. According to the CBOE, between 55% and 60% of options contracts are simply closed out prior to expiration. In other words, a seller who sold-to-open a contract will, on average, buy-to-close it 55-60% of the time, which could be at a profit before expiration. Very few option premium sellers are holding the short contract through to expiration, rather they are closing their position when the risk/reward ratio favors buying them back for a profit instead of holding the open risk until expiration.

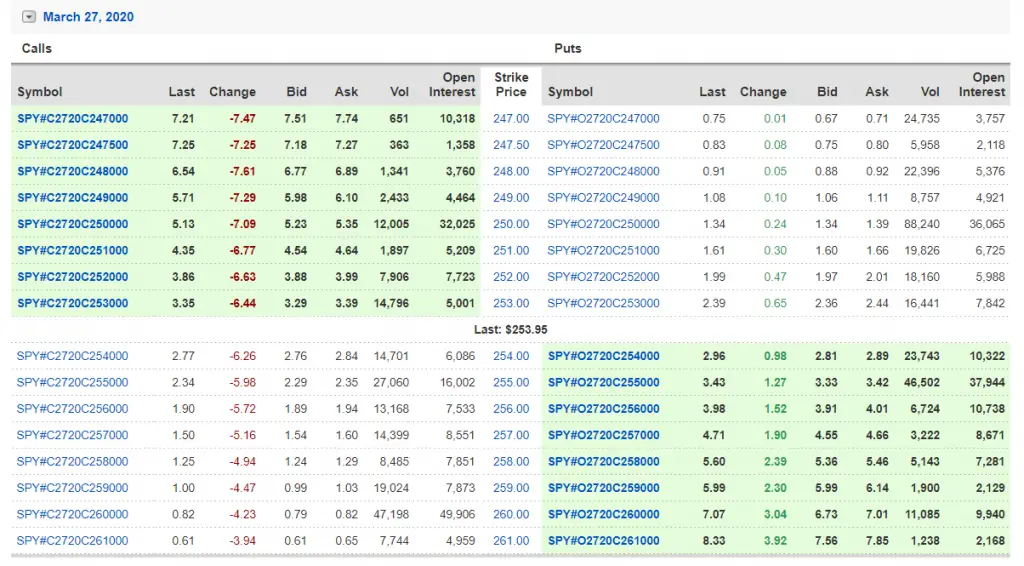

The below example shows the max pain expiration price would be with $SPY at $255 as all the the calls below and put options above would expire worthless designated in white on the below option chain.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.