A death cross is one of the most popular bearish moving average crossovers in the trading world. It is a bearish signal that means the stock market is in a downtrend and could go much lower when the 50-day simple moving average crosses under the 200-day simple moving average from above. It shows a loss of price momentum to the upside and that the current path of least resistance is to the downside.

It is a longer term trend following type of signals and is used by some to sell their long positions due to the risk of more losses, sell short, or use it as all overall bearish market indicator.

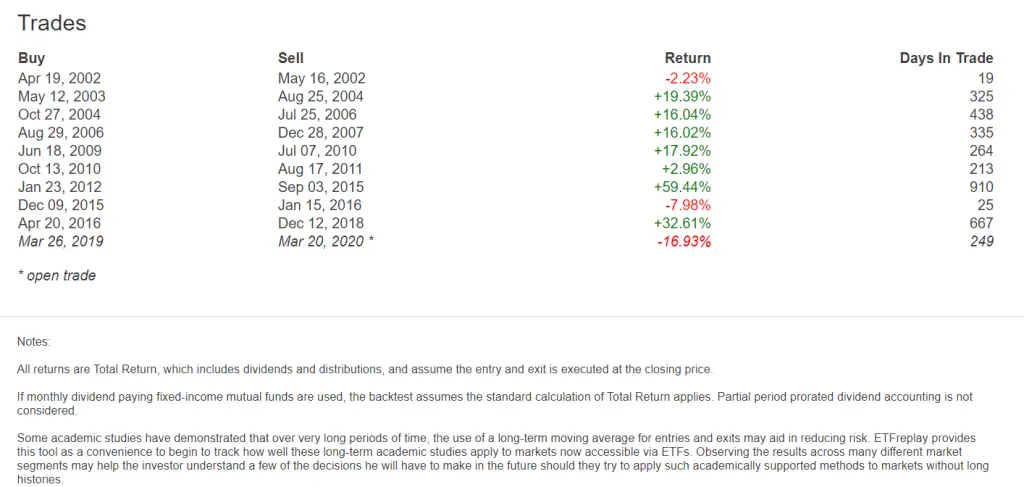

Here are the time periods over the last 20 years where the $SPY ETF was under a death cross:

May 16, 2002 to May 11, 2003

August 25, 2004 to October 26, 2004

July 25, 2006 to August 28, 2006

December 28, 2007 to June 17, 2009

July 07, 2010 to October 12, 2010

August 17, 2011 to January 23, 2012

September 3, 2015 to December 9, 2015

January 15, 2016 to April 20, 2016

December 12, 2018 to March 25, 2019

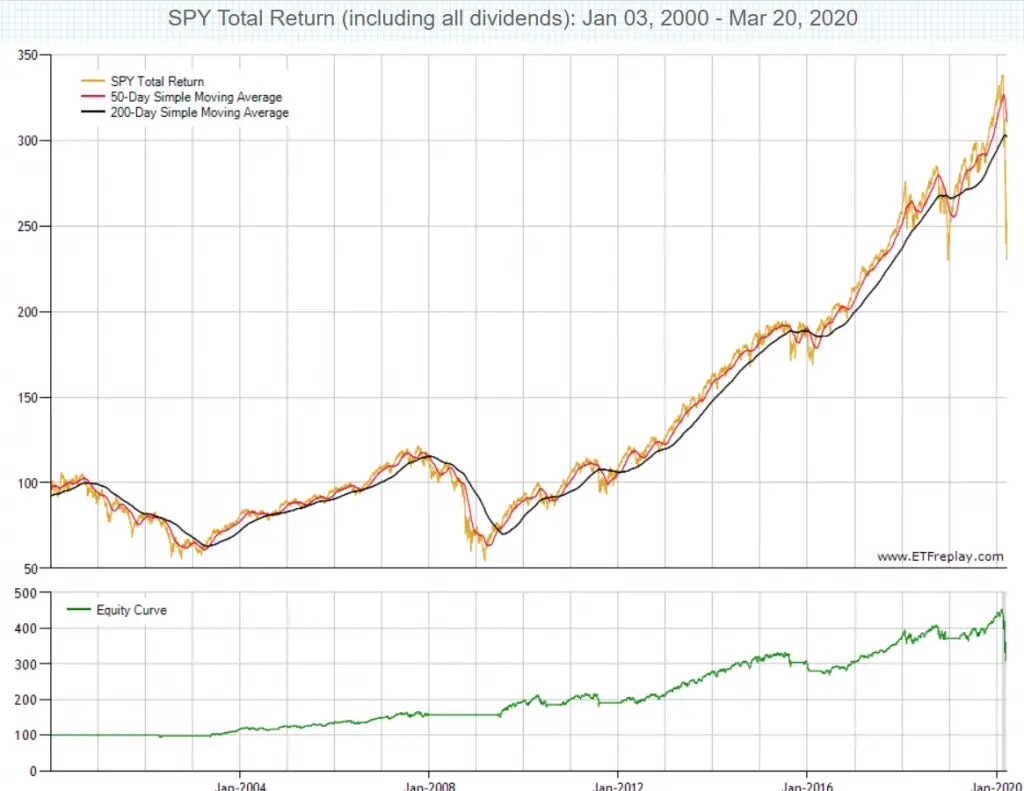

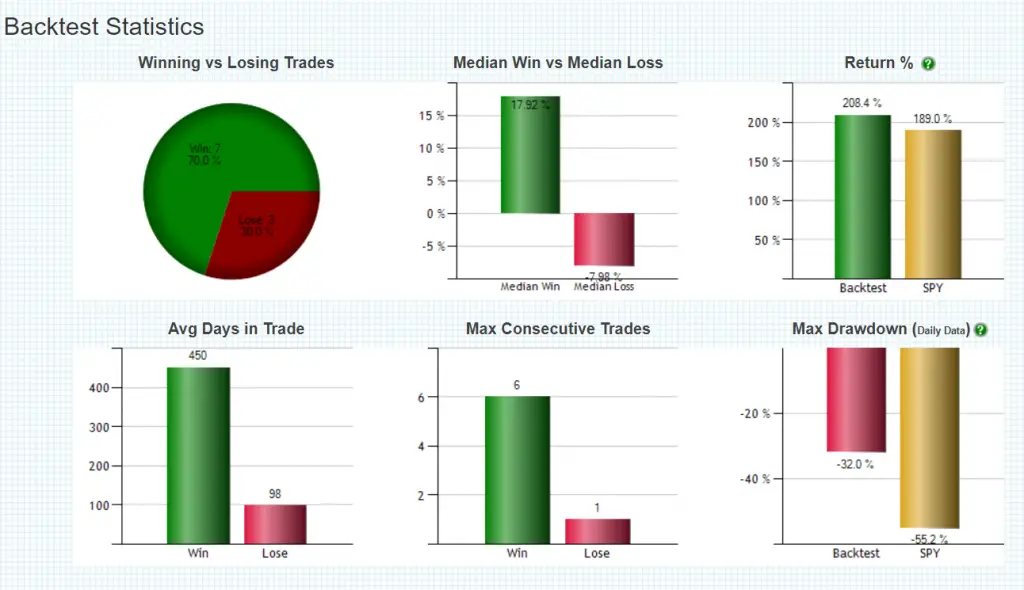

The below backtesting data shows a chart with the crossover entry signals and cross under exit signals, these statistics are for using it as a signal to go to cash, and the time periods you would be long if used it as a trend filter going long when the 50 day simple moving average crossed back over the 200 day simple moving average and had the inverse ‘golden cross’.