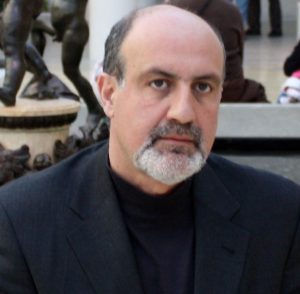

Nassim Nicholas Taleb is a best selling author, philosopher, scholar, and statistician. He had a long career as a professional option trader and hedge fund manager. His expertise was as a risk analyst focusing his work on the problems of outliers and fat tail events of randomness. His books go into depth about the nature of probability and solutions for managing uncertainty.

Here are some of his best quotes about price action trading in the financial markets.

“Probability is not a mere computation of odds on the dice or more complicated variants; it is the acceptance of the lack of certainty in our knowledge and the development of methods for dealing with our ignorance.” –

“When you develop your opinions on the basis of weak evidence, you will have difficulty interpreting subsequent information that contradicts these opinions, even if this new information is obviously more accurate.” –

“They think that intelligence is about noticing things are relevant (detecting patterns); in a complex world, intelligence consists in ignoring things that are irrelevant (avoiding false patterns)” –

“People overvalue their knowledge and underestimate the probability of their being wrong.” –

“When you ask people, ‘What’s the opposite of fragile?,’ they tend to say robust, resilient, adaptable, solid, strong. That’s not it. The opposite of fragile is something that gains from disorder.” – Nassim Nicholas Taleb

“Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.” –

“Fragility is the quality of things that are vulnerable to volatility.” – Nassim Nicholas Taleb

“Don’t tell me what you think, tell me what you have in your portfolio.” –

“You start betting aggressively whenever you have a profit, never when you have a deficit, as if a switch was turned on or off. This method is practiced by probably every single trader who has survived.” –

“No individual can get the same returns as the market unless he has infinite pockets and no uncle points. This is conflating ensemble probability and time probability.” –

“How much you truly “believe” in something can be manifested only through what you are willing to risk for it.” –

“Traders, when they make profits, have short communications; when they lose they drown you in details, theories, and charts.” – –

“The market is like a large movie theater with a small door.” –

“You will never fully convince someone that he is wrong; only reality can.” – –

“A price can drop by ten percent because of a single seller. All you need is a stubborn seller. Markets react in a way that is disproportional to the impetus.” –

When N.N. Taleb quizzed students on the best strategy to profit in casinos. Lot of answers but no one got the right one: start a casino.