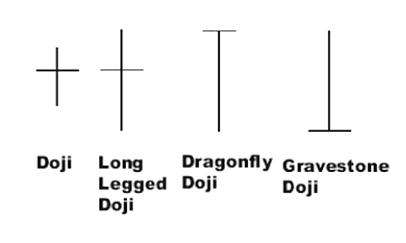

The doji candlestick is a chart pattern in technical analysis that is usually formed from a small trading range in a time period where both the open and closing price are nearly equal. A doji candlestick usually signals indecision for a direction in a market. A doji is not very significant inside a range bound market that is not clearly trending in one direction as the market is already indecisive.

A doji that forms after a long term trend in one direction has more meaning as a potential signal for a reversal or end of a current trend. A doji shows the beginning of a loss of momentum in the current market direction as equilibrium is reached for buyers and sellers at the same price point by the end of trading that time period.

Doji stars are created when opening and closing prices are close to the same, outside the context of a chart dojis are neutral patterns. A doji can signal the end of a trend when it forms in an extremely overbought or oversold market.

A long legged doji shows a lot of indecision about the trend continuing. The longer the wicks the greater the indecision in the market. These can happen to set potential tops or bottoms in charts that are very extended from key moving averages.

The Dragonfly doji is created when the opening and closing price are near the same and both happen near the highest prices of the time period. It has a long lower wick that can signal that the direction of a downtrend may be at a turning point when they happen after a long sequence of lower highs and lower lows.

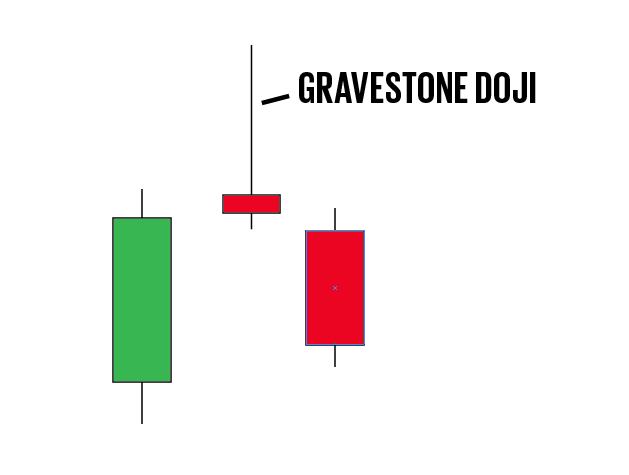

The Gravestone doji is created when both the opening and closing prices in the time frame are close to the same and happen near the low of the time frame. It usually has a very long upper wick on the candle showing that sellers came in all day to reject further upward movement of the trend and can be a signal that the uptrend is close to reversing and going sideways or down.

Candlestick signals have more meaning after they receive confirmation of the projected move on the appearance of the next candle in that direction.