Simple interest is only calculated on the original amount of capital inside a set time period. It does not include the compounding effect of returns on new money accrued. Simple interest can be used over any time period but annual returns is the one that is most commonly used. Simple interest is calculated on original principle alone. Compound interest includes the additional gains on capital in previous periods. Simple interest is on principle while compound interest can be said to be “interest on interest.”

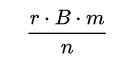

Simple interest is calculated according to the following formula:

where

r is the simple annual interest rate

B is the initial balance

m is the number of time periods elapsed and

n is the frequency of applying interest.

Here is an example of 12% simple interest on capital for one year:

$112,000 = $100,000 X 0.12% = $12,000 + $100,000

Here is an example of compound interest at 12% over a one year period compounded monthly at 1% resulting in a +12.63% annualized return, this contrasts to simple interest as the returns on new capital creates the compounding of returns.

| Monthly | Compounding |

| 1% | |

| $100,000 | $101,000 |

| $101,000 | $102,010 |

| $102,010 | $103,030 |

| $103,030 | $104,060 |

| $104,060 | $105,101 |

| $105,101 | $106,152 |

| $106,152 | $107,214 |

| $107,214 | $108,286 |

| $108,286 | $109,369 |

| $109,369 | $110,462 |

| $110,462 | $111,567 |

| $111,567 | $112,683 |

The compounding of capital can be a very powerful tool for capital growth while simple interest sets the time frame of returns.