The time value of money is the measurement of the benefit of getting money in the present instead of the same amount at a later time in the future. It is based on the preference of when you receive money on a time line.

Time value of money is the reason interest is received. Interest is paid to the depositor on saving accounts and to a lender for debt to compensate the lenders and depositors for the time value of their money. People and businesses allocate their capital in search of returns and consider both the risks and the growth when making their decisions.

Investment capital is also directed in the context of the time value of money. Traders and investors will buy investments or place trades for potential future returns instead of spending their money now if they see a high enough potential of growth to make the risk worth it.

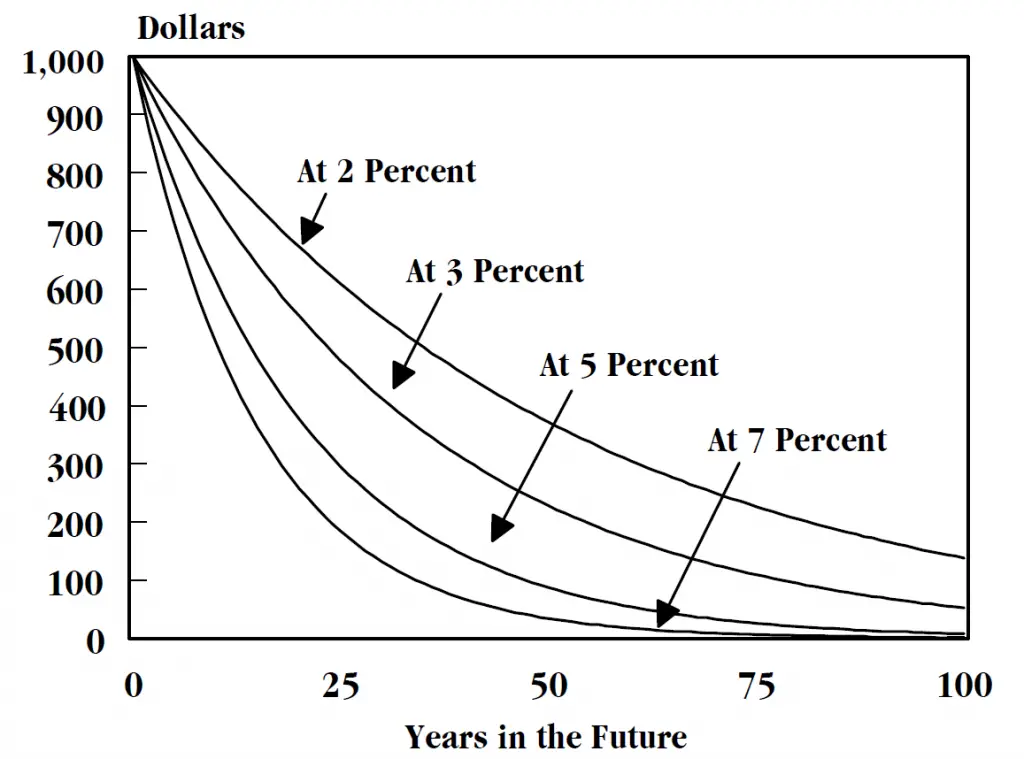

The present value of money is the worth of money today based on its future volume of cash flows that are at a quantified rate of return. Estimates of the probability of future cash flows are always “discounted”; the greater the discount rate, the less the current value of the cash flows in the future. Setting the correct discount rate is important in properly valuing potential future cash flows for earnings, interest, or dividends.

A discount rate projects the required rate of return on an investment that could make it worth the amount of risk involved being in the investment. In many situations the federal funds rate is used as the discount rate to show the comparison of an investment to risk free returns.

The present value of an annuity is measured by what the series of payments or receipts will be worth as projected into the future. Some examples are calculating the value of leases and rental properties on an asset based on future cash flows. The potential future value of an annuity is based on the stream of payments invested to earn a rate of interest.

The future value is the projected value of an investment, asset, or cash at a specified date in the future. This is measured based on the value of that asset in contrast with the expected value of appreciation compounded into the future.

The time value of money formula projects the future value of money by calculating a current amount of money and the number of years that it can compound at the current interest rate or rate of return.

The time value of money formula is:

FV = PV x [ 1 + (i / n) ] (n x t)

- FV = Future value of money

- PV = Present value of money

- i = interest rate

- n = number of compounding periods per year

- t = number of years

One of the biggest filters to calculate the destruction of the value of money into the future is the current rate of inflation on a currency.

Congressional Budget Office (Congress of the United States)