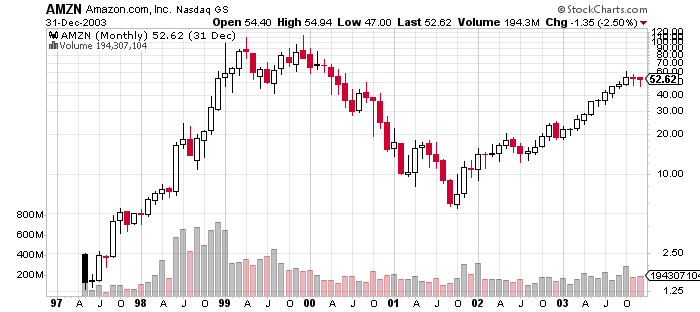

Amazon was taken public in 1997 with an initial public offer (IPO) that priced its stock at $18 per share.

Amazon’s first stock split was in June of 1998 with a 2 for 1 split with the amount of outstanding shares doubling in count and halving in price. Then another split happened just months later, this was an additional 3 for 1 stock split in January of 1999. Then another one more 2 for 1 stock split in September of 1999, This means that investors in the original IPO that held Amazon shares from the first day then had 12 shares for every one original share after all the splits. Of course the price also divided equally to the new quantity of shares but the price continued to go higher through the end of 1999.

It topped out at $113.00 in December of 1999 during the Dot Com bubble.

After the Dot Com bubble burst Amazon stock bottomed out at a price of $5.51 in October of 2001.

Amazon stock price 1997-2003

Chart Courtesy of StockCharts.com

Amazon was a survivor of the Dot Com bust that saw the majority of stocks not only plunge in price but many of the companies go out of business. Amazon went on to dominate online retailing and win as the undisputed leader of the sector. As many of its competitors in traditional retail went out of business Amazon’s stock surged to make repeated all time highs until 2018.

The all-time high price for Amazon stock was set at $2050.50 on September 04, 2018.

Amazon has never paid a dividend to shareholders.

Here is the full stock chart over the entire existence of Amazon stock.

Amazon is up approximately 95,000% since its IPO in May 1997, an annualized return of about 38% a year through 2018.