A call option is a contract that is created by an option trader selling to open a financial contract that gives the buyer of the call option the right to buy a stock or commodity at a set price before a specific expiration date. The asset that the option price value is written on is called the underlying.

For stock options, contracts are written for 100 shares of stock. So an option price quote is multiplied by 100 to get the price of a stock option contract. The only time option contracts are not for 100 shares is when the underlying stocks splits or reverse splits.

The call option buyer does not have to hold the contract to expiration and exercise it. During the life of the call option contract the buyer can trade the option on price fluctuations at higher or lower prices as it fluctuates based on the price of the underlying contract.

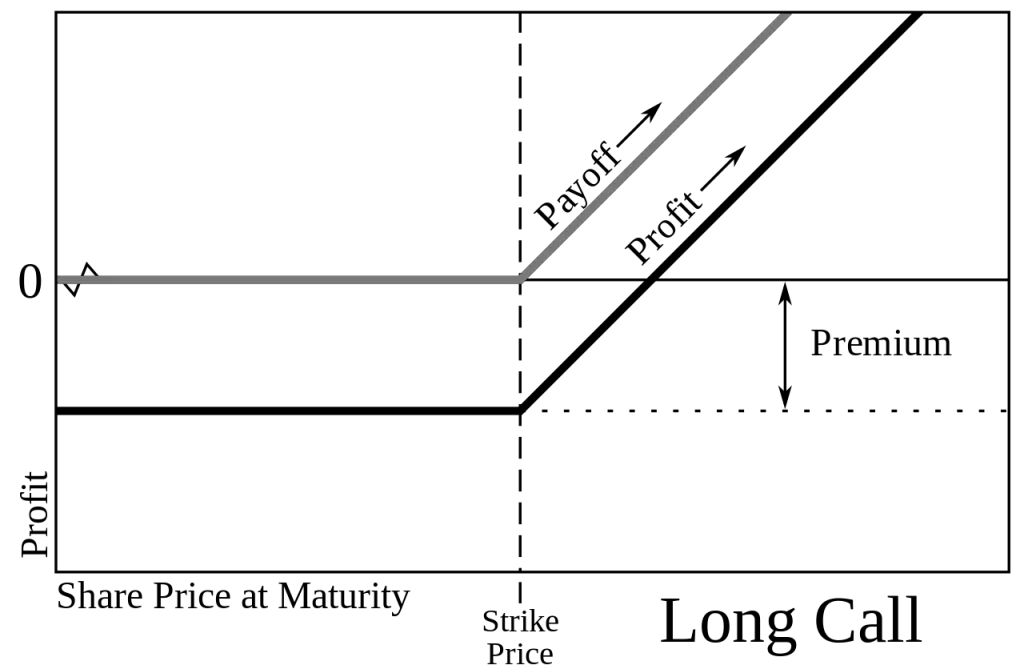

The call option buyer makes money when the underlying asset goes up in price increasing enough to drive the value of the option higher.

Call options are the opposite of put options, a put option buyer as the right to sell the underlying asset at the strike price before the expiration date.

Call options can be sold as a covered call when the underlying asset that the contract is written on is owned by the seller. The buyer pays the cost of the call option for the right to profits of the underlying stock by expiration.

Call options are not investments they are bet and a speculation on the magnitude of the price movement of the underlying within a specific time period.

Call options are valued using the Black Scholes option model using the Greeks.

The call option delta is the amount the price should move based on a $1 move in the underlying asset. This is determined by the changing probability of the option expiring in-the-money.

Gamma is the amount that delta should change on a $1 move in the underlying asset price. Delta is the speed at which option prices adjust to the underlying, Gamma as the rate of acceleration of that change.

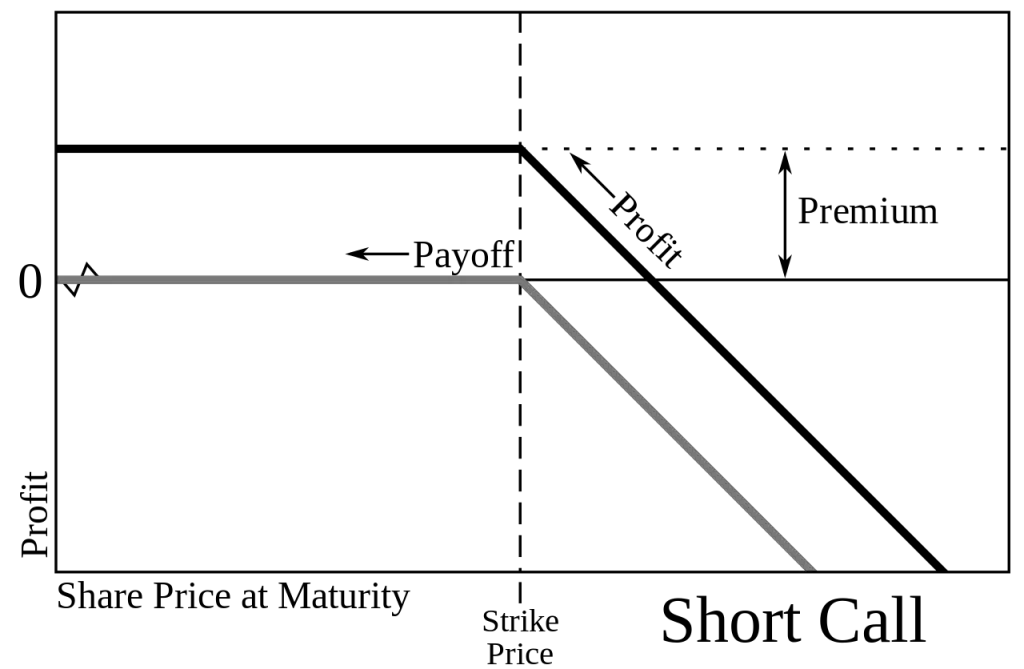

Theta is the time decay or the amount that the option contract drops in value each day as expiration of the call approaches. Theta decay drops the value for the option buyer and goes in favor of the option seller that is short the call option.

Vega is the amount a call option price should move for each $1 change in implied volatility. Vega tries to price in the risk to the seller of a big price move before expiration.

Call options can be great trading tools for income generation on existing stock positions by selling covered calls repeatedly. Calls can also be bought to create leverage on long positions in stocks in place of equity. Call options can bring in the dynamics of, leverage, time, and the magnitude of price change as new elements for stock traders.

Call option are neither good not bad they can be a part of any trading strategy if the their risk is fully understood.

I have created this Options 101 eCourse here for a short cut for stock traders that want a quick and easy way to learn how stock options work.

Image by Gxti wilkimedia.org