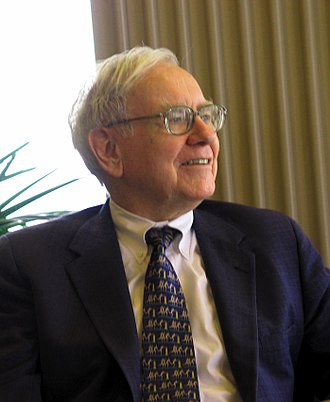

Warren Buffet’s current net worth is $82.7 billion in U.S. dollars making him currently the third richest person in the world. The question for many is how did he build this level of wealth?

Buffett was very interested in creating businesses and investments. At seven years old he was inspired by a book he checked out of the public library: One Thousand Ways to Make $1000.

Buffett started his wealth building ventures as a kid. His childhood business ventures included selling chewing gum, Coca-Cola bottles, and weekly magazines door to door. He also worked retail in the grocery store owned by his grandfather. In his high school years he delivered newspapers, sold golf balls he recovered from a local golf course, he sold stamps, detailed cars, and he and a friend also spent $25 to buy a used pinball machine that they were allowed to place in a local barber shop. They liked the cash flow that it created so they bought a few more pinball machines to place in three more barber shops. The pinball machine business was later sold in less than a year for $1,200.

His first investment firm was Buffett Partnership, Ltd that he created in 1956 at 26 years old and it eventually acquired the textile manufacturing firm Berkshire Hathaway that was on the verge of slowly going out of business.

Warren Buffett began purchasing Berkshire Hathaway stock in 1962 after noticing a price action pattern of the stock to go up after the company closed a mill. Buffett knew that the textile manufacturing business was dying in the U.S. and Berkshire’s fundamentals were not going to get any better as it went out of business but was looking for a quick investment gain as its price was so low in comparison to its asset liquidation value.

After being offended a tender offer to buy his shares that was below a verbal agreement Buffett decided to buy more Berkshire stock in 1964. He decided to take control of the company and fire the guy that went back on the oral agreement to buy his shares at a higher price than the tender offer. This put Buffett in a situation where he was now the majority shareholder of a failing textile business.

He pivoted the company from textile manufacturing to insurance and kept the name to create a diversified holding company. He used the cash flow from insurance premiums to acquire the best cash flowing businesses and also to hold an investment portfolio of great businesses that he would buy when a stock of a great company was at a good price. Berkshire Hathaway grew into a corporate conglomerate that is now the fifth biggest company in the world.

Warren Buffett allowed Berkshire Hathaway stock to grow in price to six figures as he did not want a stock split of its Class A shares because he wanted long-term investors in his company’s stock not short-term traders and speculators. In 1996 Berkshire Hathaway did finally do a partial stock split to create Class B shares through a Unit Investment Trust and kept the per-share value of the smaller shares close to 1⁄30 of the original Class A share price.

Over 99% of all of Warren Buffett’s wealth and net worth was created by buying and holding Berkshire Hathaway stock. This is just about the only stock he owns personally and directly. When you hear about the Warren Buffett portfolio or Buffett stocks this generally refers to the Berkshire Hathaway holdings in the company stock portfolio, which is valued at over $250 billion and built with the stocks of about 43 companies currently.

Warren Buffett first bought Berkshire Hathaway shares in 1962 for $7.50 a share. In 2019 Berkshire Hathaway Class A shares are $322,000 a share which is a +4,293,333% gain over his first initial purchase price for any shares he still holds at the time he took over the company. The Berkshire Hathaway stock annual return (CAGR) is approximately +20.26% for the past 57 years.

Warren Buffett’s wealth was built through his personal ownership of one stock: Berkshire Hathaway. It was his management as CEO and Chairman of his insurance company’s cash flow into building a portfolio of companies and stocks that created a juggernaut of a company that was worth far more than its competitors through acquisitions and portfolio management. Warren Buffett used Berkshire Hathaway as an indirect wealth building machine.