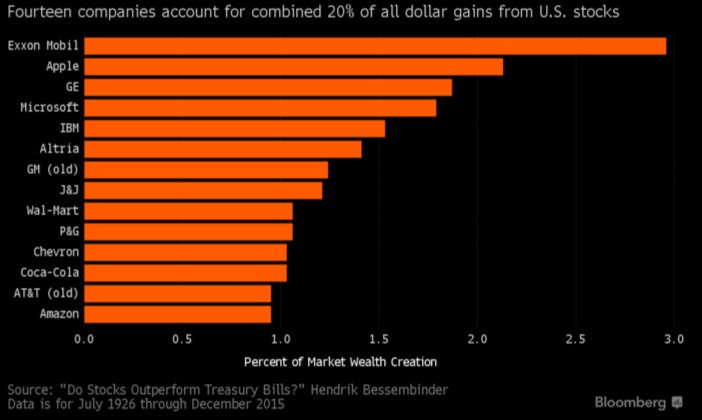

The majority of stock market gains come from a small amount of stocks. A few stocks dominate their sectors and markets and are able to continually acquire smaller companies or innovate and grow in size and earnings over long periods of time. Below is an example of companies that created the majority of stock market Alpha over the past 90 years.

Buy and hold investing does not work with most individual stocks as many go down or nowhere in price for years and most will eventually go to zero. Buy and hold works over the long term with stock market indexes because they are designed to always have the winning stocks in them buy they way the index system works by removing the losing stocks and including the winning stocks.

Many stocks after their initial public offering flounder and make all time highs early and never return to those highs as going public was the exit strategy for the early venture capitalists. While other IPOs go on to be built into the world’s biggest corporations with their founders in leadership roles for decades.

Returns since IPO of some of the market leading stocks:

- Strong leadership

- Competitive edge that will be difficult for others to replicate

- Brand recognition

- Growing industry

- No real competitors

- They have a monopoly in their industry

- They focus on the future not the past

- Diversified business model

Here are the ten companies I think are the strongest currently that have a high probability of market out performance over the next 20 years.

- Berkshire Hathaway BRK.B: This stock allows you to buy Warren Buffett’s life work of companies he acquired inside this insurance conglomerate that he personally believes could keep growing indefinitely even after he is gone. His track record with growing Berkshire may make him the greatest investor and CEO of all time.

- Amazon AMZN: You can partner with Jeff Bezos the winner of the DotCom wars. Bezos is also the man that took over retail along with cloud computing and currently has one of the hottest new tech devices with voice activated Alexa. He took retail over with tight cash flow restrictions what can he accomplish now with access to endless capital?

- Apple AAPL: Steve Jobs legacy was to take a company that was almost bankrupt and set it up to become the biggest company in the world. The ecosystem that Apple has created with its devices and cash flow set them up easier for the next 20 years to do whatever they want to do next.

- Alphabet GOOGL: Google is one of the greatest companies in the history of the world by becoming the gateway to the internet itself. They currently have the two most popular websites in the world with Google and YouTube. They have created a diversified portfolio of businesses and innovation that sets them up to have another big win in the next 20 years and keep their position as an innovator.

- Facebook FB: Mark Zuckerberg started the 6th most popular website in the world from his Harvard dorm room and is this generations most successful entrepreneur currently worth $68 billion and is the fifth richest person in the world at 35 years old. Facebook acquired Instagram to win the social media wars and also has Whats App and Oculus in their portfolio. Facebook is the best targeted advertising platform ever created that even rivals Google. Facebook is set up to win for the next few decades.

Of course even the best stocks can have unexpected events with other technologies or competitors that change their trajectory of success so it is crucial to have a plan for your own time frame and risk tolerance for why you get in and why you will get out based on a change in their fundamentals or technical trend. I have found one of the best ways to make money in the stock market is to create a stock watch list based on a stock’s fundamentals and then trading them with technical price signals like a 200 day moving average or a 10 day / 50 day moving average crossover as examples so you only stay long during up trends but go to cash during bear markets and when a stock is in a correction.

Whatever your stock market strategy is, I believe this is a great list of stocks to look at for investing and trading for the next decade or two.

This post is for informational purposes only and is not investment advice.