This is a Guest Post by Arnout ter Schure on Twitter @intell_invest.

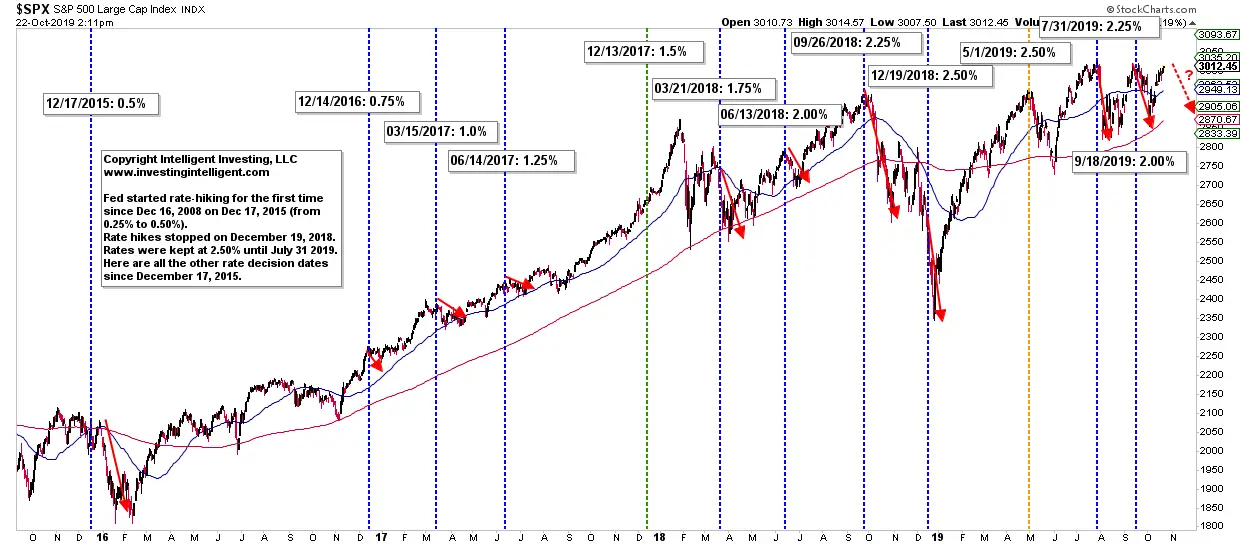

A lot has been said, and will be said, about the FED’s recent and coming rate decisions. The FED has been changing its rates since December 17, 2015 from ZIRP (zero interest rate policy) to 2.50% four years later and now at 2.00%, with another rate decision (a decrease of 0.25bp to 1.75%) expected on October 30th. In Figure 1 I’ve overlaid the FED’s rate decisions with the price action in the S&P500 and we can see that each of the 11 prior rate changes has been met with a decline in the markets, except one (December 13, 2017). Some declines were bigger (late-2018) than others (all of 2017). In addition, in May 2019 rates were kept unchanged but the market didn’t like that decision either. Hence, a rate change decision by the end of the month will likely be met with selling based on the twelve prior instances.

Figure 1: SPX daily chart with FED rate decisions

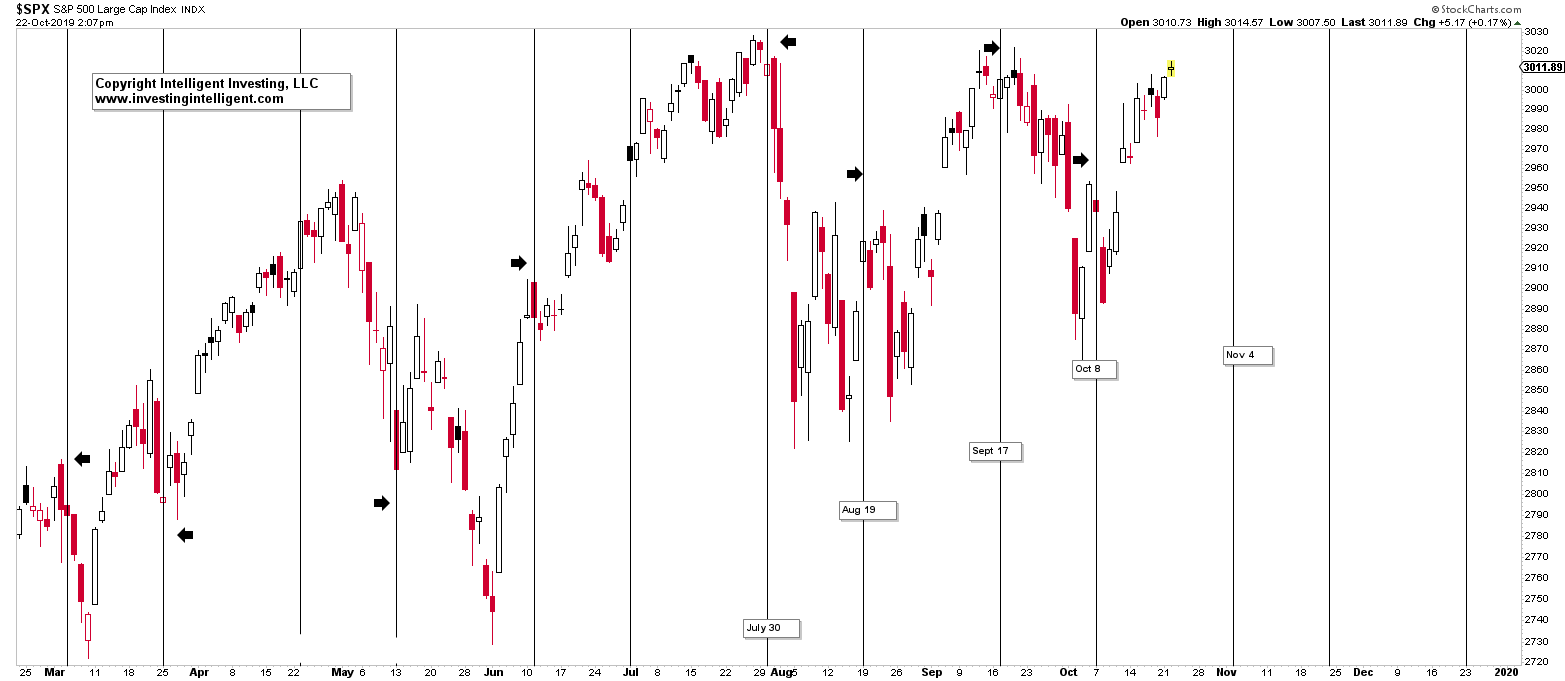

Note, the FOMC meeting ends right at an important Bradley Turn Date (October 30; 40/100 Bradley Siderograph Power, see here), and is also right at the beginning of my own Fibonacci-timing Turn date of November 4, which are always +/- 3 trading days (October 30 – November 7). See Figure 2 below.

Figure 2: SPX daily chart with Fibonacci-timing turn dates.

Lastly, I also wanted to cover the decision by the FED on October 4 (see here) to:

- Conduct overnight repurchase agreement operations (REPO) at least through January of next year (2020) by a per-counterparty limit of $30 billion per day to mitigate the risk of money market pressures that could adversely affect policy implementation. The latter is a euphemism for “markets will otherwise face liquidity issues…”

- Purchase Treasury bills up to $20 billion per month at least into the second quarter of next year to maintain over time ample reserve balances at or above the level that prevailed in early September 2019.

You can see the increase in the FED’s balance sheet since early September 2019 here. From current levels this will mean an increase in its balance sheet by about $200B. Thus, we now have an accommodating FED, who is essentially doing a QE4 without calling it QE (and which will thereby undo almost its entire balance sheet reduction (~15%) that started late-2017. Given where the economy currently is (record low unemployment, growing wages, etc) the lowering of the interest rates and increase in the balance sheets are in my opinion now not done to improve the economy as it was meant during QE1 through QE3, but instead the FED is responding to liquidity issues in the (debt) markets as the money markets saw funding shortages on September 16/17, driving the rate on one-day loans backed by Treasury bonds as high as 10%, about four times greater than prior week’s levels. More importantly, this caused the FED’s funds rate to jump to 2.25%. Such an increase that if left unchecked could have started impacting broader borrowing costs in the economy. IMHO this is another sign of a late-stage Bull, not the start of another multi-decade Bull run as the spike wasn’t evidence (yet) of any sort of imminent financial crisis, but a sign of the FED losing control over short-term lending, one of its key tools for implementing monetary policy. It also indicated Wall Street is struggling to absorb record sales of Treasury debt to fund a swelling U.S. budget deficit.

Trade safe!

Arnout Ter Schure PhD

Founder and President Intelligent Investing, LLC

Vice President NorthPost Partners, LP