This is a Guest Post by Pierre Abdulahad of www.pa-fx.com.

Have you ever looked at a chart and had doubts if what you see is a Triangle or not? If so, then keep reading. In this article I will cover everything you need to know about Triangle trading:

- Different Types of Triangles.

- Identification Guidelines.

- Trading Tactics.

- Best performance rules.

- How to place Entry, Stop-Loss and Take Profit levels.

Why Triangle Trading?

The Triangle is one of my favorite chart patterns. Triangles can tell us many things about the market that we’re intending to trade, or when we’re doing our charts drawings and when planning a trade. They give you signs of momentum change, possible breakout areas and much more. So learning to trade Triangles will help you to be in the right place at the right time. Isn’t that every trader’s dream?

As with all the other chart patterns, you have to train your eyes to find them. Another thing that might make it even harder, is the different way that traders perceive the pattern. You surely witnessed a discussion between traders about chart patterns once before. It doesn’t take long to see how differently we all perceive the market signals, also what the chart is telling us. How can we deal with that conflict of views? Rules and Guidelines is your best solution to almost all trading related decision. So let’s start looking at some guidelines on how to identify a Triangle Pattern.

Definition of Triangle

A triangle is a polygon with three edges and three vertices. That is the simple geometric definition of a Triangle. Everyone that has been trading, even for a short while, knows for sure that textbook stuff and reality on charts are different. So let’s dig into the sweet and neat stuff.

Identification Guidelines

After spending some time on charts, you’ll see that spotting Triangles in the chart is pretty simple, maybe too simple. The main guideline is to not force the pattern in the chart. What I mean is if the pattern feels like it’s jumping on you, screaming, “I am a Triangle”, then it is. But when you have doubts about it then most of the time that means it’s not the right Triangle to trade. So simply do not trade it under those circumstances. It would be way better to save your capital for a better trade, where the Triangle formation is clear and valid.

The different types of Triangles

There are three different types of Triangles:

- Ascending Triangle

- Descending Triangle

- Symmetrical Triangle

Ascending Triangle Trading

The chart below shows us a textbook example of an Ascending Triangle. We will also discuss the rules we will use so that we never have any doubts as to whether the pattern is valid or not.

Here we see how the price reversed twice at the same level, building a horizontal resistance area with equal highs. Every time the price reaches that level it reversed back down. On the other side, the lows are getting higher on each swing, building a bullish trend line. To be a valid pattern, the price should approach the top horizontal line at least two times. (in other words, two distinct minor highs). Similarly, the price must make two distinct higher lows shaping the up sloping trend-line. The two trend lines meet at the triangle apex, but prices usually break out of the formation well before then.

Why do Ascending Triangles form?

Imagine a big institution or a bank has purchased a good chunk of a particular asset.

After seeing the price trending for a long period, the institution starts to have a feeling that the price of that asset is now overvalued, so they hit the sell button. Now when you have a huge amount of contracts, you can not sell everything in one go, without making the price plummet. So the institution will tell the trading department to sell, let’s say Gold futures, and sell at $1500.

Now that level has a huge sell order block, so each time the price reaches that $1500 all buy orders will get absorbed, so then prices start moving down again. The seller will put a ceiling at that level. Now word gets around that Institution X is selling and other jumps on the bandwagon. That aggressive sell pushes prices lower, bulls start getting interested to buy at a fair value again. Those bulls will push prices back to that $1500. Again, since there are still orders left, prices bounce down crossing to the other side of the pattern. The trading department makes the call confirming all sell orders are now confirmed sold.

Now, without the big chunk of orders (Supply), there will be nothing in the way for the bulls, so that’s when we see the price breaking out of the pattern. But the supply and demand game is not over yet. There are still players in the market selling Gold at an even higher place, where they think it’s a good value to sell at. That’s what makes prices move back and retest the top of the Triangle pattern, to then push back up away and in a strong momentum most of the time.

Ascending Triangle Trading Rules

| Triangle shape | Two trend lines, the top one horizontal and the bottom one sloping up, form a triangle pattern. The two lines join at the triangle apex. |

| Horizontal top line | Prices rise to and fall away from a horizontal resistance line at least twice (two minor highs). Prices need not touch the trend line but should come reasonably close (say, within $0.15). The line need not be completely horizontal but usually is. |

| Up-sloping bottom trend line | Prices decline and rise away from an up-sloping trend line. Prices need not touch the trend line but should come close. At least two trend line touches (minor lows) are required. |

| Crossing pattern | Prices must cross the chart several times; they shouldn’t leave a vast amount of white space inside the center of the Triangle. |

Descending Triangle Trading

In the chart below, we can see what the Descending Triangle looks like. This is a textbook example, they will not always look so perfect. For the Descending Triangle we have the same rules but oppositely (see rules below). The reason they happen is also the opposite of the Ascending Triangle, so to save your time, I am not explaining that again.

Descending Triangle Rules

| Triangle shape | A triangular-shaped pattern bound by two trend-lines, the bottom one horizontal and the top one sloping down, that intersect at the triangle apex. |

| Horizontal Support Line | A horizontal (or nearly so) base acts to support prices. Prices should touch the base at least twice (at least two minor lows that either touch or come close to the trend line). |

| Down-sloping top Trend Line | A down-sloping price trend that eventually intersects the horizontal baseline at the apex. Prices should rise and touch (or come close to) the sloping trend line at least twice, forming two distinct minor highs. |

| Crossing pattern | Prices must cross the chart several times; they shouldn’t leave a vast amount of white space inside the center of the Triangle. |

Symmetrical Triangle Trading

Price forms at least two lower highs and higher lows, following two sloping trend lines that eventually intersect.

In the chart below we have an example of the Symmetrical Triangle. Prices rise to the start of the formation and make a new high. Thereafter prices cross the formation from side to side, making lower highs and higher lows. We can see our rules are being followed, with at least two distinctive swings high and two distinctive swings low, forming the two trend lines. In this particular example prices did three swings on each side, which makes the pattern look perfect.

Why do symmetrical triangles form?

Prices zoom up making higher highs. Eventually, selling pressure gets stronger and prices turn down. Swing traders, sensing a change in trend, quickly sell their holdings, adding additional pressure. Prices fall to a level where prior support set up by the earlier structure or various other factors entice investors to view the traded asset as a bargain. The price is shooting up, they reason, so why not join the trend, especially now that it is cheaper?

Such rationalizations increase demand and send the asset up again, but this time the momentum players that missed a chance to sell earlier do so now. Others, believing that there may not be enough upward momentum to carry the stock to the old high, sell too. The selling pressure halts the price rise at a lower level and turns it around.

Value investors seeing the asset drop, and since the fundamentals have not changed, buy it on the way down. Some add to their positions at a lower price and others buy it for the first time. The buying may force prices to move horizontally for a bit instead of straight down. Eventually, though, a higher low form not so much from anxious buyers, but a dearth of sellers.

Throughout the trend, the volume is decreasing. Fewer and fewer contracts change hands and it becomes easier for the asset to change direction. Eventually, though, a large buy order comes in and price rises. When it pierces the top trend line, it takes out the orders that investors have placed to buy when the price rises above the trend line. This additional buying pressure makes prices soar.

If demand is strong enough, prices continue rising. About half the time, prices reverse back to the triangle boundary for a retest. There prices meet support at the top trend line or the level of the triangle apex. Usually, prices rebound and continue in their original direction. Sometimes, though, prices continue down, signaling an end to the upward trend.

Breakouts and Fake-outs

How can you be sure the breakout is real and not a fake-out? Well, no one can. A fake-out is when the price closes outside the boundaries of the Triangle pattern. After a couple of candles and mostly after one candle, the price reverts inside the Triangle again. It is easier to spot a fake-out when trading stocks since the volume will usually be low on such breakout. While in the Forex market, it’s a bit harder, since we do not have the real volume of the whole Forex market. But usually breakouts during late NY session, or during the Asian session, where liquidity is much lower, you see fake-outs happening. (Rule of thumb and not to be used as a blueprint)

In the chart below, we see an example of a failed pattern. Both first and second breakout failed to move away from the top trend-line. Prices went against the first bullish breakout, surely triggered the buyer’s stop losses. This example reminds us that we can never be sure about the market direction, no matter how good the pattern looks. As a trader, you have to accept the losing trades, they will always happen.

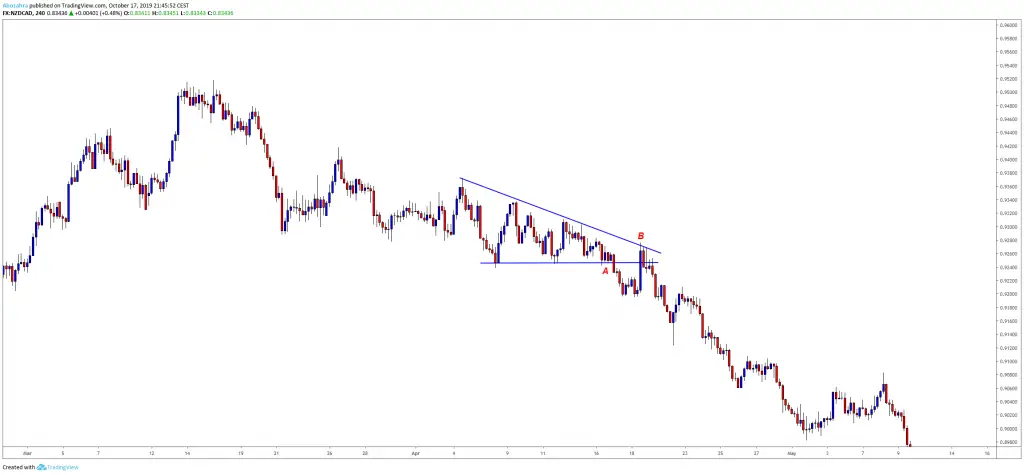

Here we have another example, the price broke the Descending Triangle horizontal support line at (A). Price went down, the trade seemed to go in the direction for the sellers. After some candles, the price reversed back inside the Triangle but never broke above the top trend-line at (B). So, in this case, the upper trend line of the original Triangle was still valid and sellers shouldn’t close the shorts, as far as no break above the top trend-line.

Once a Triangle pattern has a legitimate breakout to the upside, what can we expect to happen next? Prices will move in a strong momentum away from the top Trend-line as we have at (A) below. Most of the momentum will happen due to the stop losses from the seller at the top getting triggered. Also many times (Almost 50%), you’ll see the price going back to test the top line once again (B) in the chart above. That will give you another chance to enter the trade. The pattern will have a higher win rate if traded in the direction of the prevailing trend (Bullish in this example). That way you will have the benefit of trading in the direction of the major time frame. (The trend is your friend kind of thing).

Triangle Trading Tactics

So, I think by now you can identify all types of Triangles. Don’t you? I hear you screaming, how to trade them!? So let’s start looking at some examples, talk measures, entries, targets, and stops.

The measuring rules for Triangle Trading targets: Compute the height of the Triangle’s base, do a projection of that projection from the area of the breakout, in the direction of the breakout. The end of that projection is your target.

Triangle Trading stop loss: The textbook says that we put stops below the low of the Triangle’s base. While I don’t like that. In the example below I would put my stop loss above the two major higher highs in the middle of the Triangle. Since if the price to break above both the down sloping trend-line and the second higher high, that is enough evidence that the market changed direction and a reversal is happening. Below how I would trade this Descending Triangle.

Triangle Trading on the retest: In the example below we have a nice example of a break and retest. So if you didn’t trade the first breakout, you have the chance to enter on the retest. Stop loss above the high of the Triangle’s base and the target is a projection of the base’s height projected to the downside from the area of the breakout.

Another good example of a break and retest trade, these trades give you a much better risk to reward. The reason for that is the retest that happened, it gave us a much better entry-level. In this example, we have a great stop loss placement above the base of the Triangle (Textbook Stop Loss placement).

Below I am showing you another Triangle Trading á la Pierre. I am not saying “My way or no way”. What I am trying to do here, giving you options to work with. It’s up to you to use what you feel more comfortable with.

Some extra tips about Triangle Trading:

- Trade breakouts that happen in the direction of the prevailing trend for a better win rate ratio.

- Trading the retest is safer than trading a premature breakout.

- Patterns that are both tall and narrow, will most of the time give you a strong momentum breakout.

- Triangle breakout with heavy volume is a much stronger signal.

- Do not trade breakout that happens near a major resistance or support level.

I hope you found this article helpful and you learned something new. Just remember one thing, no pattern will not fail from time to time. On the other side, that should not stop you from trading a pattern.

So what next? Now it’s time that you hit the charts and start look for Triangle patterns and do some back-testing on your own. It’s always better when a trader does his research, that way you’ll have much more confidence in the pattern you’re trading.

Images created with: tradingview.com

This has been a Guest Post by Pierre Abdulahad of www.pa-fx.com.

You can see more from him here: