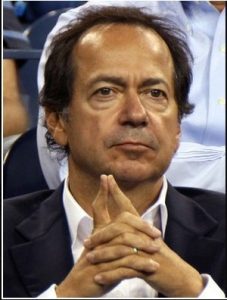

Legendary trader John Paulson is a hedge fund manager that leads the Paulson & Co. he founded in 1994. He made one of the biggest fortunes in Wall Street history in 2007 when he earned almost $4 billion personally and became a legend in the industry. Paulson used credit default swaps to place a trade against the U.S. subprime mortgage lending market. Paulson earned an additional $4.9 billion personally in 2010 by being long gold with size. Paulson & Company owned securities that represented the value of 96 metric tons of gold. He has made some of the best trades in history in both size and magnitude of moves in his favor. Forbes estimates his net worth to be $4.2 billion as of September 2019.

Here are ten quotes that can give us clues into his mindset and process for achieving such incredible out sized results multiple times.

“Many investors make the mistake of buying high and selling low while the exact opposite is the right strategy to outperform over the long term.” – John Paulson

In his view the majority of unsuccessful investors and traders buy high and then sell low. He believes the big money is creating a great risk/reward ratio by selling high overbought price levels short and buying the deep oversold levels.

“Investors that do the best, and have done the best, are those that stay and compound at above-average rates over the long term.” –

John Paulson

The big money is not in one off trades and investments then taking the profits off the table. The big money returns happen by compounding capital across a string of good trades and investments.

“I think buying a home is the best investment that any individual can make.” – John Paulson

John Paulson thinks buying a house is one of the best ways to create return on your capital in the markets.

“No one strategy is correct all the time.” – John Paulson

There is no Holy Grail trading strategy that makes money in every market environment. Every trading and investing strategy has losing streaks and drawdowns in capital from equity peaks.

“Our goal is not to outperform all the time – that’s not possible. We want to outperform over time.” -John Paulson

You can’t beat the market every year but you can over time beat the market in the long run.

“If you rent, the rent goes up every year. But if you buy a 30-year mortgage, the cost is fixed.” – John Paulson

You can stop the price action of rent going against you by locking in a mortgage on your own house. Buying a home is a hedge against inflation and property values raising your rent.

“In these times of uncertainty for paper-based currency, I feel more secure in holding gold.” – John Paulson

Gold is a hedge against the devaluation of fiat currency.

“Stock market goes up or down, and you can’t adjust your portfolio based on the whims of the market, so you have to have a strategy in a position and stay true to that strategy and not pay attention to noise that could surround any particular investment.” – John Paulson

John Paulson is a position trader that believes in trading based on a thesis that has a high probability of playing out in the long term regardless of short term noise.

“Historically, gold has always been a safe haven against inflation and a safe haven in times of political instability.” – John Paulson

Gold is a hedge against inflation and a good safe haven currency if your country’s regime is not stable.

“Don’t focus on weekly or monthly returns.” – John Paulson

Short term price action can be random and less meaningful than higher time frames. Start your focus on your strategy performance based on annual returns and multi-year time frames.