A price action trading system is a process for using new price data to make buy and sell decisions on a watch list of markets. A price action trading system attempts to use entry and exit signals that have an edge by creating good risk/reward ratios that lead to profitable trading. There are five primary components in a trading system.

-

- You will need a watch list, depending on what markets you trade this list could be futures, Forex pairs, ETFs, or stocks. The items on your watch list should have good liquidity that creates tight bid/ask spreads that limit slippage. Your watch list can be filtered using fundamentals but should only be traded using price action. It is a good practice to trade markets that historically has had good trends in the past and consistent repeatable price patterns over the long term

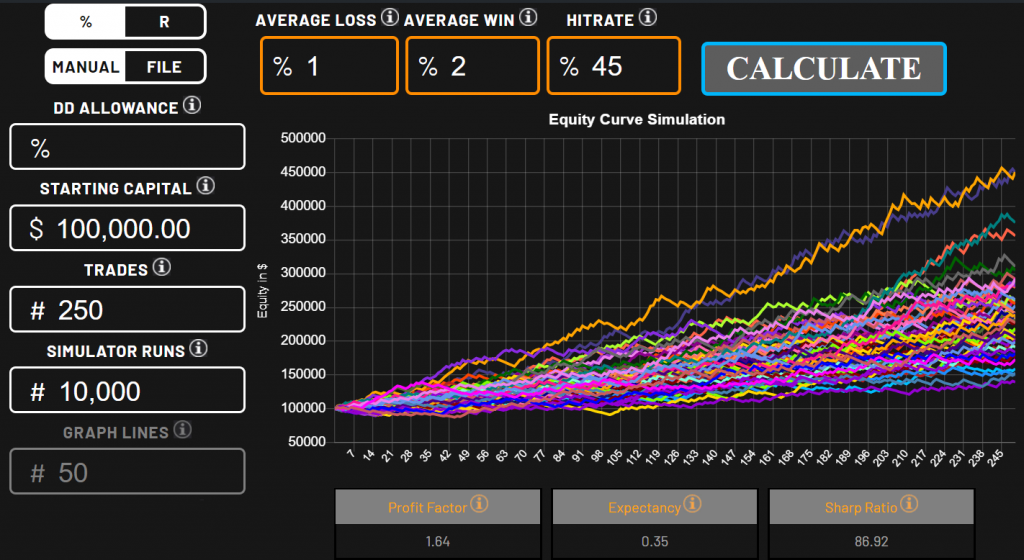

- You need to backtest your watch list and study the historical price action patterns to find signals that have created good risk/reward ratios in the past. This means when you enter a trade your initial stop losses being triggered will create a small loss if the trade doesn’t work out, but your trailing stop and/or profit target will create a big win if it does.

- To manage the size of your drawdowns and eliminate your risk of ruin you will have to set guidelines for position sizing based on historical and implied volatility of the market you are trading. Also you have to consider the correlation of your positions and set parameters of how many open positions you can have if they move together or diversified.

- A good trading system can have diversified signals for trends, swings, and dip buying. This can help smooth the equity curve through different market environments.

- The trading system you choose to use must fit your own personal tolerance of risk and have the potential of meeting your return goals. You have to understand your edge and believe in the trading principles that will make your system profitable over the long term. You have to be able to mentally and emotionally deal with the inevitable drawdown that it will have when a market environment changes and have the perseverance and patience to trade it with discipline over the long term to achieve profitability.