IRAs and 401Ks are designed to enable people to save money in investment accounts by offering tax advantages for doing so. These retirement accounts were meant to replace the defined employer pension plans of the past. With a pension plan an employee received a defined perpetual payment every month from their employee based on years of service. With an IRA or 401K it is undefined, benefits are determined by the amount saved and how well the investments in the plan performed over the period before retirement.

There are several types of retirement accounts available in the United States.

Traditional Individual Retirement Account (IRA): This is a personal account that the individual holds with a brokerage and is free to invest in any stock, exchange traded fund, or mutual fund. Many even allow covered call writing inside the IRA. But no margin trading is permitted in an IRA. When you contribute to an IRA your deposits are tax deferred and lower your taxable income for the year of the deposit. There are no capital gains taxes inside an IRA so your capital grows tax free. Income taxes on IRA money is deferred until the time of withdrawal as it is needed in retirement. If you withdraw IRA money before you are 59 and a half years old the withdrawal becomes taxable income and you have to pay a 10% penalty.

Roth IRA: The difference with a Roth IRA versus a traditional IRA is the sequence of paying income taxes. Deposits into a Roth IRA are not tax deferred you pay income taxes on the year of the deposit. However, you do not pay income taxes on your Roth withdrawals at retirement because you already paid them at the time of deposit. You also do not pay capital gains taxes on the returns of your investments inside your Roth.

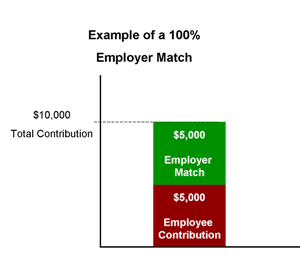

Traditional 401K: This is an account set up and managed by the brokerage firm of your employer’s choosing. A 401K is in your name and the investment options are usually limited to the mutual funds chosen by the employer sponsored program and sometimes you can invest in the company’s stock. Your ability to move around money and trade is usually limited to end of day. When you contribute to a traditional 401K account your deposits are tax deferred and lower your taxable income for the year of the deposit. This can come right out of your paycheck and direct deposited into your 401K account. Your pay stub will keep track of your deposits and they will be noted on your W2 at the end of the year. Income taxes on 401K deposits are deferred until the time of withdrawal as it is needed in retirement. If you withdraw 401K money before you are 59 and a half years old the withdrawal becomes taxable income and you have to pay a 10% penalty. Many employers will discount purchases of a company stock or match deposits. If the company offers a discount percentage on a stock purchase that is a return on entry and should be considered as a great opportunity. A company match on a deposit is a 100% return at the time of the deposit. Always try to deposit enough to get the full company match, it is the only free lunch you will get in investing. There are no capital gains taxes inside your 401K so your capital grows tax free.

Roth 401K: The Roth version of the 401K is the sequence of taxes just like the Roth IRA. You do pay income on the deposit now on a Roth 401K so you don’t have to pay the income taxes on your withdrawal later while also allowing your investments to grow tax free.

The answers to these question for you: “Which one is better for you an IRA or 401k?” “A Roth or a traditional account?”

Depends on your answers to these questions:

When do you want to pay taxes? Now with a Roth or later with a traditional account. It makes sense to do a Roth now if you are in a very low tax bracket and if it grows substantially then you do not have to pay taxes at retirement. If you are in a very high tax bracket it makes more sense to get relief from income taxes now and defer them until retirement where you will likely be in a lower bracket.

Do you have access to a company match on your 401K contribution? If you have an employer match program then you should do a 401K to get access to the 100% return and maximize it. It is the easiest and only risk free 100% return you will ever make in any market.

The top considerations for the Roth versus the 401K is the tax implications. The top considerations for an IRA versus a 401K is access to a company match on the contribution.

The information in this blog post or for informational and educational purposes only and are not meant and investment of tax advice. Always seek the advice of a tax professional before making retirement decisions.