Here are ten reasons a stop loss is so important in trading:

- A stop loss defines your price risk by quantifying what price level you will exit a trade at.

- A stop loss helps define your trade size. By knowing what price you are going to exit a losing trade you can set your position size based on your stop loss to define the size of your loss.

- You can’t control how big your win will be or if your trade will hit your profit target but you can define the size of your loss by getting out at your stop loss price level.

- A stop loss removes big losses from your trading strategy.

- A stop loss frees up capital to move on to find winning trades.

- You can save a lot of mental and emotional capital by getting out of a losing trade early.

- The risk component of your risk/reward ratio is set by your stop loss and position size. Without a stop loss you can’t have a risk/reward ratio.

- A stop loss caps your downside risk to a specific amount, this removes a lot of stress and the risk of ruin in one trade.

- In option plays the option hedge part of the play acts as a stop loss.

- A stop loss is a way of forcing a trader to admit that they are wrong about a trade, it keeps the ego in check.

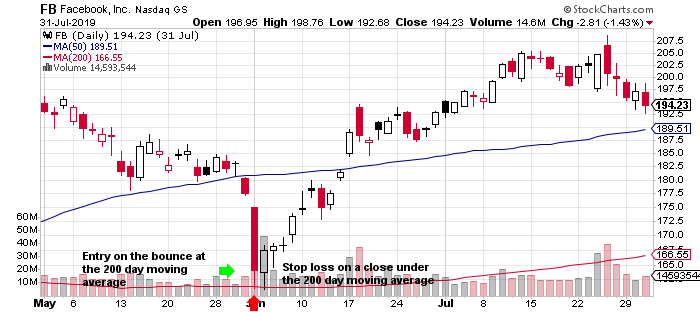

In the below example I entered on the price bounce at the Facebook 200 day simple moving average. My stop loss was a close under the 200 day simple moving average. Since it did not close under the 200 day SMA I let it run for a winning trade for seven days until it closed below the previous days low, that was my trailing stop loss as it turned into a winning trade.

Chart Courtesy of StockCharts.com