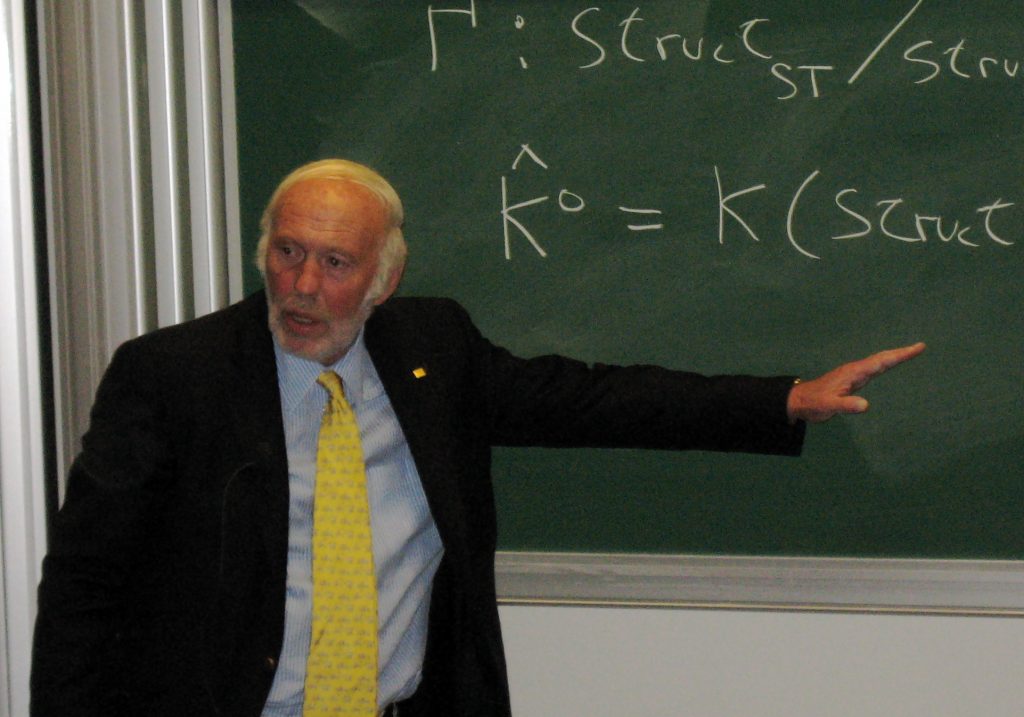

Jim Simons was a hedge fund manager and a mathematician. He was a quantitative investor and the founder of the hedge fund Renaissance Technologies. His hedge fund specialized in systematic trading using quantitative models derived from mathematical and statistical analyses. Mr. Simons primary models were on pattern recognition. He contributed to the development of string theory by providing a theoretical framework to combine geometry and topology with quantum field theory. Jim Simons was a mathematics professor from 1968 to 1978, and chair of the mathematics department at Stony Brook University. He founded his hedge fund in 1982. His net worth was estimated at $21.5 billion in recent years before his death.

“Renaissance’s flagship Medallion fund, which is run mostly for fund employees, “Is famed for one of the best records in investing history, returning more than 35 percent annualized over a 20-year span”. From 1994 through mid-2014 it averaged a 71.8% annual return.Renaissance offers two portfolios to outside investors—Renaissance Institutional Equities Fund (RIEF) and Renaissance Institutional Diversified Alpha (RIDA).” via Wikipedia

Here are some of his top trading quotes that distill some of his wisdom:

“Past performance is the best predictor of success.” – Jim Simons

“There’s no such thing as the goose that lays the golden egg forever.” – Jim Simons

“In this business it’s easy to confuse luck with brains.” – Jim Simons

“We don’t override the models.” – Jim Simons