Trend following is the process of trading in the direction of the markets price action and staying with the trend until it ends. A trend follower must have a quantified winning process for entering when there is a signal and then either exiting for a small loss when a trend fails to be established or if a trend does begin to ride it as far as possible to maximize the size of the profits. There are many different ways that trend followers accomplish this, here are five of the most common indicators used.

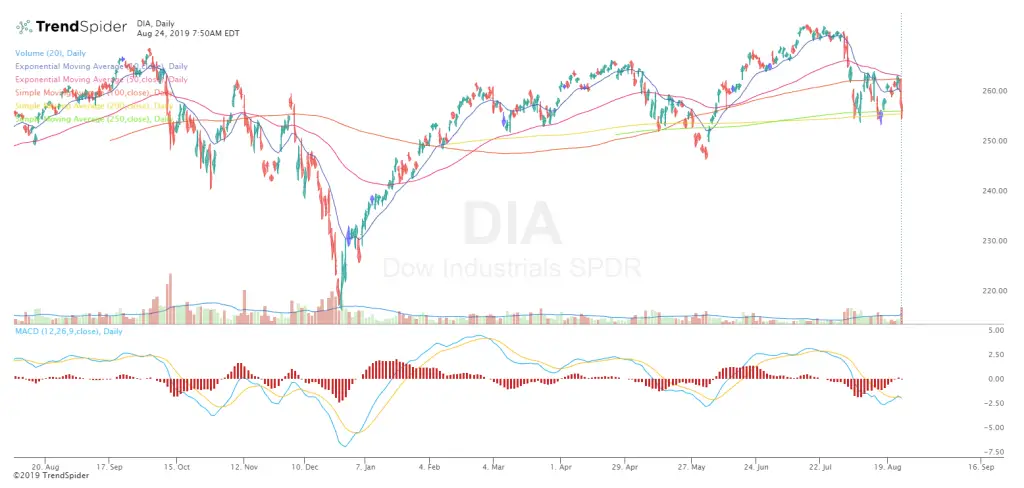

- Long term moving averages are used to filter the trend of the price action, a trader will enter on the break of a long term moving average as then stay in the position until the moving average is breached again. Two of the most popular moving averages for this type of trend following are the 250 day and the 200 day simple moving average. These are two lines that backtest well across many markets and are long enough to filter out most of the volatility and false moves the majority of the time.

- Another strategy is to combine two moving average indicators and trade the trend when they crossover. A signal is generated and a position is taken when a short term moving average crosses over a longer term moving average and then the position is exited when the short term moving average crosses back under the longer term moving average. A cross over system can further filter out much of the volatility and false signals that a single moving average will give when a market gets stuck in a trading range.

- A trend follower can also use a new high as an entry signal in a set time period. Like going long when price makes a new high in a 20 day time period and exiting when price makes a new low in the ten day time period. This is another way to catch a trend and also exit to lock in profits or exit for a small loss when the trend starts to reverse.

- Buying a break out to a new all time high or a 52 week high is another way to stay in the path of least resistance and in the strongest markets.

- Another popular trend following indicator of the potential for a big trend beginning is a break out of a trading range to a new short term high in price after a long consolidation. Many times the stop loss is initially set at a close back inside the old trading range.

Of course position sizing is crucial to stay in the game when markets fail to trend and hand you a loss it is important to keep it small. There is no magic in these trend following indicators they are just potential high probability entry areas for the start of a new trend, the profitability comes in the small losses and the big wins.

Chart Courtesy of TrendSpider.com