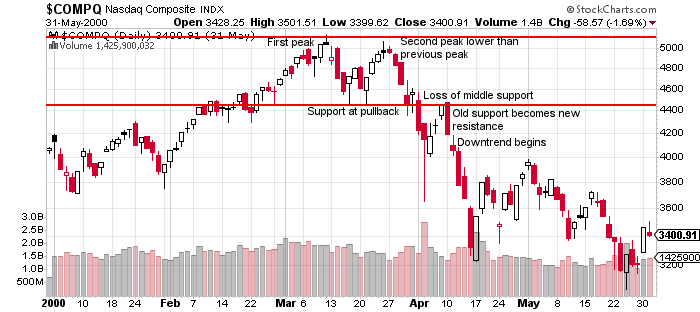

Chart courtesy of StockCharts.com

The Double Top Chart pattern is a reversal pattern that is bearish. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices at resistance price level tests.

Chart Facts:

- A double top chart pattern happens at the end of an uptrend that has likely gone on for weeks or months.

- The first bounce off resistance where price stops going up is the first level of price resistance.

- The first rejection and reversal in the uptrend is small and the short term pullback is usually about 5% to 10% off the resistance highs.

- The first pullback from the highs bounces and price returns to the close to the previous resistance but is usually a little lower than the previous high of resistance.

- The previous price resistance highs hold on the second test.

- The second test of resistance must be confirmed by a reversal and pullback as there is only a potential pattern until resistance holds and price is rejected off the previous resistance with higher volume and sometimes a large bearish candlestick or a gap down in price.

- If there is a close in price above the previous high the double top is invalidated and the odds are that the uptrend continues.

- A breakdown under the low price that occurred in the middle between the double top resistance levels is a full confirmation momentum signal of the double top reversal pattern. This is the level where a signal to sell or sell short is given.

- Selling short at a higher price after the rejection of resistance at the second top has lower odds of success but a better risk/reward ratio.

- A double top chart pattern can take weeks and even months to play out with the middle pullback to support taking many different sizes and shapes.

This is a historical example in the NASDAQ Composite of the double top during the Dot Com mania in March of 2000. $COMPQ at 5,132 was the first peak only to find support twice near 4,455 before the next run up to a lower high at 5,078. The neckline break and close below support at 4,455 was a sell short entry signal. The old support became the new resistance before the downtrend started a strong move. That was the top for over a decade.

Chart Courtesy of StockCharts.com

Chart Summary: This pattern is one way to locate high probability short selling opportunities after an extended uptrend in price. It also gives you a way to quantify your stop loss if you choose to take the short sell off the second resistance level your stop would be a close above the first price level of resistance. If you short sell a trend line breakdown of the middle line of support then the stop loss can be set with a break back above the middle support line.