“Successful trading depends on the 3M`s – Mind, Method and Money. Beginners focus on analysis, but professionals operate in a three dimensional space. They are aware of trading psychology their own feelings and the mass psychology of the markets. Each trader needs to have a method for choosing specific stocks, options or futures as well as firm rules for pulling the trigger – deciding when to buy and sell. Money refers to how you manage your trading capital.“ – Alexander Elder

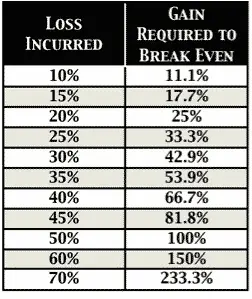

In the pursuit of profits many traders focus on the management of trade entries and maybe even the trade exit after more experience. A trader will learn the hard way that they must also manage their mind after having trouble with letting stress, emotions, and ego cause them to not follow their trading plan. Money management usually comes last after learning how dangerous big losses are to a trader’s capital and confidence. As you destroy your capital with losses it takes more and more effort just to get back to even. If you are down -10% you need an +11.1% return to get back to even. Find yourself down -20% and a +25% return will make you whole again. If you lose -50% of your total trading account you will have to double your account with a +100% return just to get back to where you started.

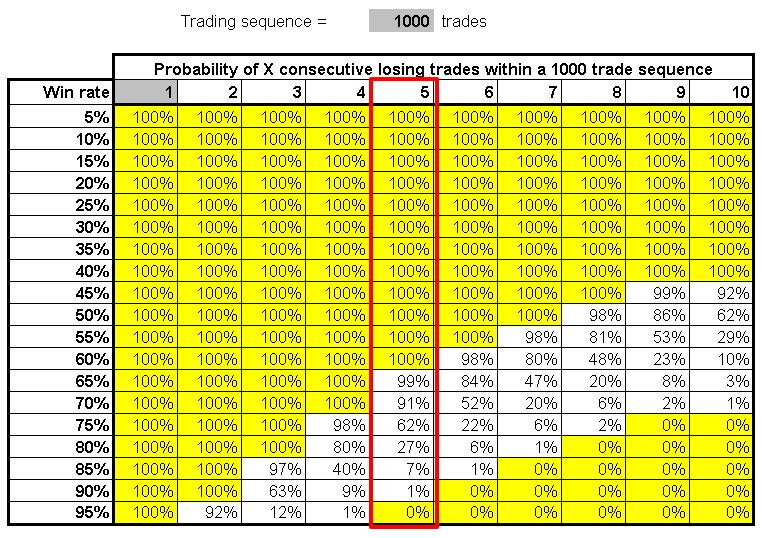

It is more wise to return +1% on your total trading capital ten times to get a +10% return than trading big trying to get it all at once. If you lose 5 times in a row while risking 1% you are down -5%. If you are going big risking 10% on every trade and you lose 5 times in a row you will be down -50%. No one trade should put your account at risk and you should not trade big enough that your first losing streak wipes you out. Can your position size survive a five trade losing streak?

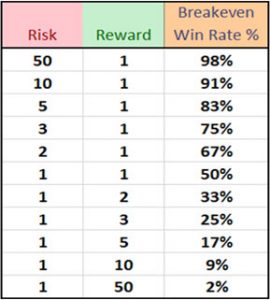

Another key money management concept is your risk/reward ratio. It is a good trade to risk $100 for the opportunity and probability to make $300 or $500 and you can win half the time and still make money. It is not a good trade to risk $1,000 to make $100, one loss wipes out ten wins, even with a 90% win rate you will lose money. You want to risk a little for the opportunity to make a lot.

Positions sizing combined with your stop loss placement are your two biggest tools for money management.

- A 20% position of your total trading capital gives you a potential 5% stop loss on your position to equal 1% of total trading capital.

- A 10% position of your total trading capital gives you a potential 10% stop loss on your position to equal 1% of total trading capital.

- A 5% position of your total trading capital gives you a potential 20% stop loss on your position to equal 1% of total trading capital.

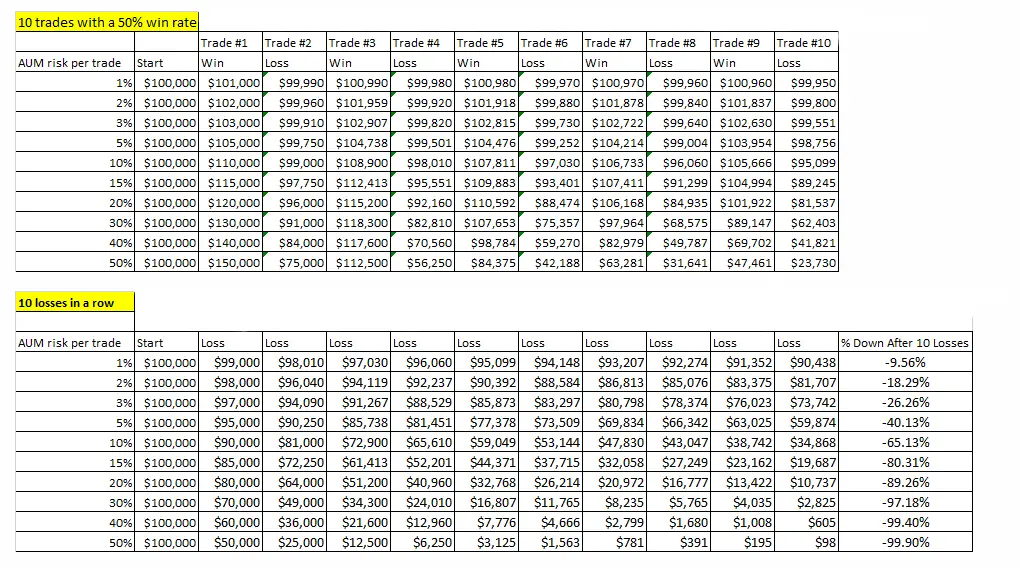

Here is an example of the different equity curves with the same winning percentage but based on different sizes of wins and losses. Also what happens with ten losses in a row based on higher risk% to capital. Look at how dramatically money management changes equity curves of the same trading system results.

“The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system.” – Ed Seykota

“The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system.” – Ed Seykota