The goal of a trend following system is to capture trends for big profits and cut losses short. A trend follower needs a diversified list of assets to trade in different markets to always have the opportunity to capture a trend where ever it happens. A good trend following system will have backtested signals on each item on their watchlist. You want a system that has you long with leverage during trends and in cash when no trend signal is present. The best trend following signals work across multiple items on your watch list.

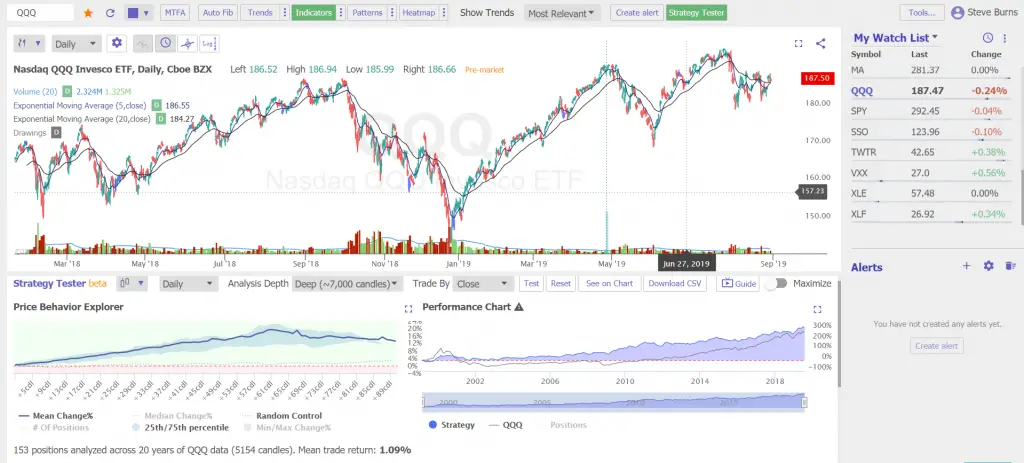

Here is an example of a simple trend following system signal for the $QQQ ETF based on buying at the end of the day when the 5 day exponential moving average closes above the 20 day exponential moving average and selling at the end of the day when the 5 day exponential moving average closes back under the 20 day exponential moving average. This repeating pattern is a good example of a momentum short term moving average smoothing out the gains from an intermediate term moving average and catches both swings to the upside and avoids most of the noise from price action cutting through a single short term moving average as a stand alone line creating a lot of false signals and volatility.

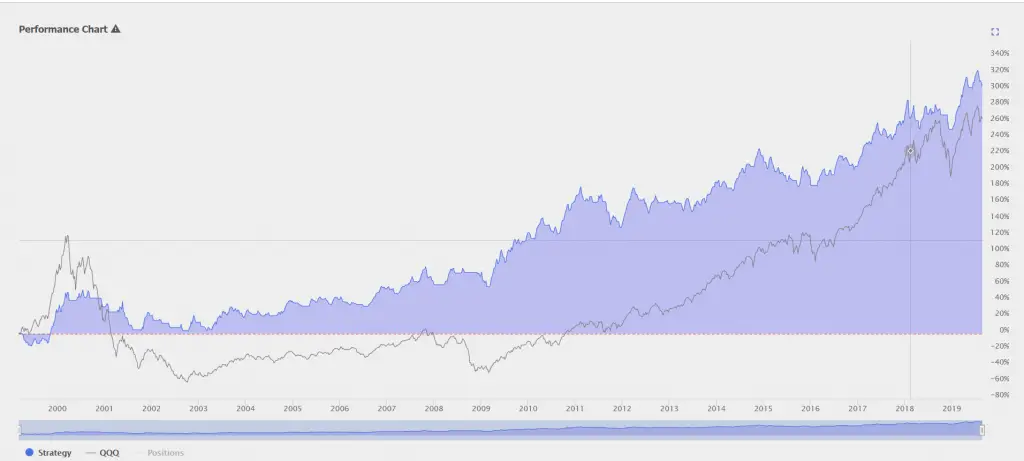

This 5 day / 20 day EMA crossover signal created a +300% return with a -38.9% draw down on the $QQQ versus a buy and hold return on $QQQ of +260% with a -83% drawdown. Any good trend following signal should create better risk adjusted returns than buy and hold on the asset backtested. Buy and hold tends to look better when markets are near all time highs but it is important to look at the full equity curve of both the signal and how long the $QQQ stayed underwater and unprofitable and how the signal kept you from losing in bear markets and crashes. Trend followers use both small position sizes for less risk exposure per trade and also leverage for maximum gains when they do capture a trend. Trading a signal on the NASDAQ with futures contracts, options, or leveraged ETFs like $QLD or $TQQQ helps amplify returns during trends. We don’t know what the future holds but a signal that lets your winners run and cuts your losses short will make money during trends.

Chart and Backtest Data Courtesy of TrendSpider.com

For more information about how to create your own moving average trend following system check out my Moving Averages 101 book here or my Moving Averages 101, Backtesting 101, or Real Trade Example eCourses here.

This post is for informational purposes and is not investment advice.