“ I always laugh at people who say “I’ve never met a rich technician” I love that! Its such an arrogant, nonsensical response. I used fundamentals for 9 years and got rich as a technician.” – Marty Schwartz

“ I always laugh at people who say “I’ve never met a rich technician” I love that! Its such an arrogant, nonsensical response. I used fundamentals for 9 years and got rich as a technician.” – Marty Schwartz

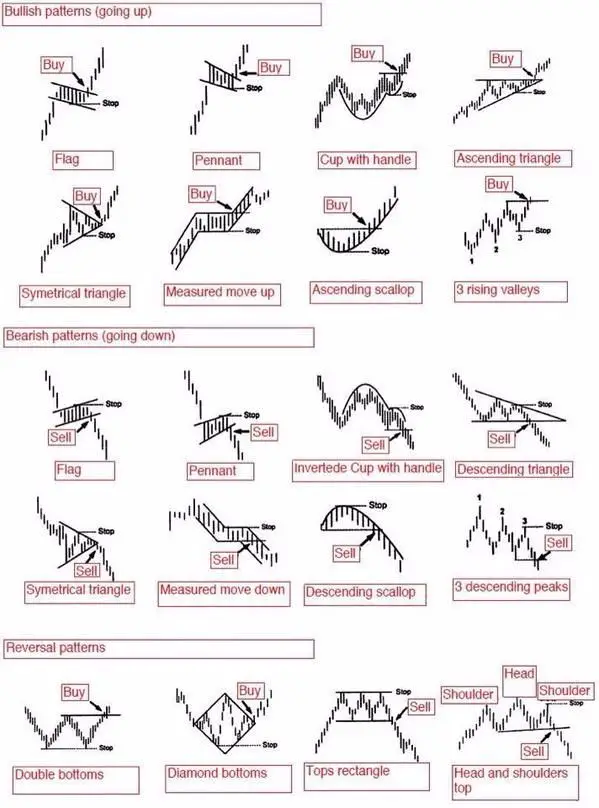

Many people believe technical analysis is complete silliness. How can someone make money on lines and patterns on a price chart? The problem is people jump to conclusions before doing the research to see if there are any rich technical analysts or if the money is only made by the fundamentalist investors. Also they have no experience trading to even see what is possible.

There is also two different types of technical analysis.

Predictive Technical Analysis: Traders project what will happen next in price movement based on a current chart pattern. They look for the clues of volume, trend lines, and the levels of support and resistance to project the probabilities of the future price movement.

Reactive Technical Analysis: Trader’s entries and exits are based on current price signals that backtest as profitable by creating good risk/reward ratios. Their quantified price signals tell them when to get in for a good probability of success and where to get out with a small loss or to lock in a profit.

The best use of both types of technical analysis is to create good risk/reward ratios on entry. You know where you will be getting out if the trade doesn’t work out and the potential magnitude of the win if you are right. This is the true value of Technical Analysis.

If you are wondering if anyone can prove technical analysis works, the answer is yes, two authors did the work and found the proof.

In his Market Wizard Book Series Jack Schwager has examples of different traders using both predictive and reactive technical analysis to make millions over long periods of time.

In his Trend Following book Michael Covel did the research on all the millionaire and billionaire traders that used reactive technical analysis to follow the trend in markets and become wealthy.

Technical Analysis alone is meaningless outside the parameters of a complete trading system. You need proper position sizing, a watch list of what you will trade, a strategy with an edge, and the discipline and perseverance to stick to your own rules and allow your edge to play out over time.

It is not a matter of a person’s opinion about whether Technical Analysis works it is a matter of proof, and if one person can do it others can too.

“I never use valuation to time the market. I use liquidity considerations and technical analysis for timing. Valuation only tells me how far the market can go once a catalyst enters the picture to change the market direction. The catalyst is liquidity, and hopefully my technical analysis will pick it up.” – Stanley Druckenmiller (Networth $4.6 billion)