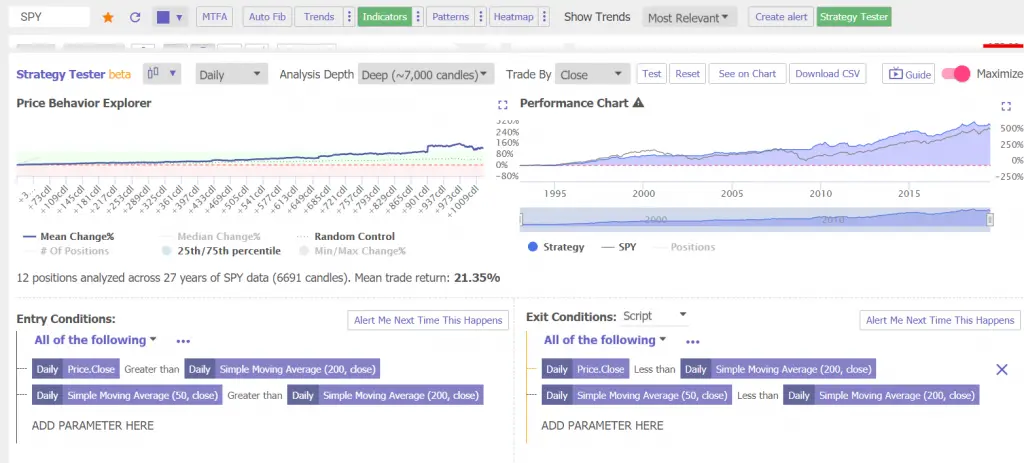

Here is an example of a simple moving average crossover strategy that beats buy and hold investing. This strategy combines two winning strategies, the golden cross 50/200 day and the stand alone price over the 200 day moving average system. These are both end of day signals based on the daily chart.

Entry conditions:

You go long if price is over the 200 day moving average and the 50 day moving average is over the 200 day moving average.

You exit and go to cash when price falls below the 200 day moving average and the 50 day moving average is also under the 200 day moving average.

The mean average trade was a win for a 21.35% profit for a 25 year backtest.

The system stayed in cash during the majority of the 2002 and 2008 bear markets limiting drawdowns.

The out performance of the system versus buy and hold was consistent after 2002.

While at times the system had huge out performance at times the final results were +625% for the crossover system versus +550% for buy and hold with dramatically less drawdowns for much better risk adjusted returns.

This is an example of an alternate to simply buying and holding through bear markets. Trend trading systems have to be built to suit your own risk tolerance return goals and for the time frame you are the most comfortable with.

Backtesting data courtesy of TrendSpider.com.