“Trend followers use reactive technical analysis. Instead of trying to predict a market direction, their strategy is to react to the market’s movements whenever they occur. This enables them to focus on the market’s actual moves and not get emotionally involved with trying to predict direction or duration.” -Michael Covel

Trading a trend in price requires you to trade in the direction of the accumulation or distribution in a market. Higher highs signal accumulation and an uptrend while lower lows show distribution and a downtrend. What is a simple way to create your own trend trading strategy? The first step is to backtest the signals on your watchlist that you think would theoretically work to capture trends and also allow you to exit with profits when the trend bends. Trend trading signals have to get you in with price momentum and then tell you to lock in your open profits at the end when the trend bends.

One of the most simple trend trading strategies is to combine moving averages into a crossover system. You go long when a faster moving average of a shorter time frame crosses over a slower moving average of a longer time period. You use your short term moving average as a signaling line over the slower one. A crossover signal helps filter a lot of the price volatility around single moving averages and avoid a lot of the false signals so you have less losses and trade less.

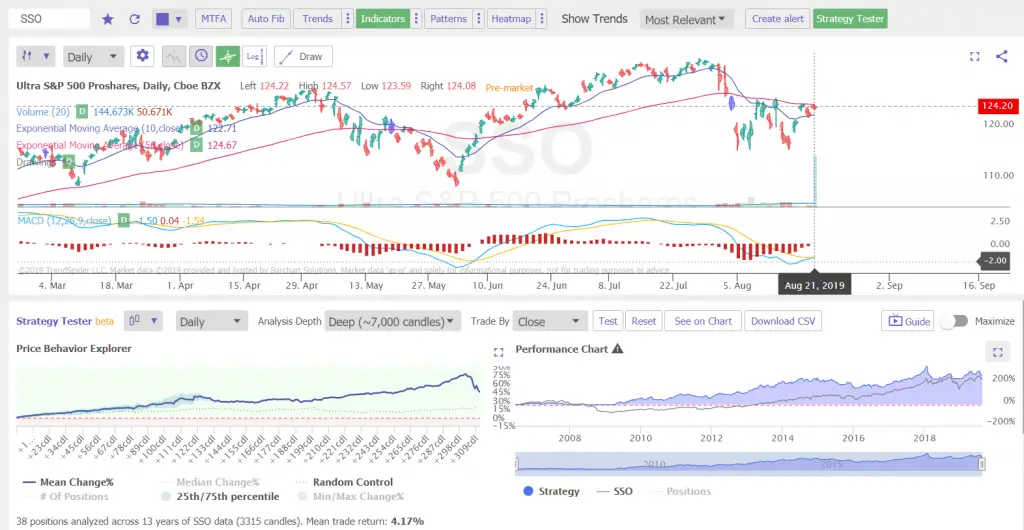

The following is an example of using the 10 day / 50 day exponential moving average crossover as an end of day trend trading signal on the $SSO chart using the Trend Spider Strategy Tester.

This trend trading strategy signals to go long when the 10 day EMA crosses and closes over the 50 day EMA and to go back to cash when the 10 day EMA crosses under and closes below the 50 day EMA. This is a simple way to introduce the principles of trend following in a systematic way.

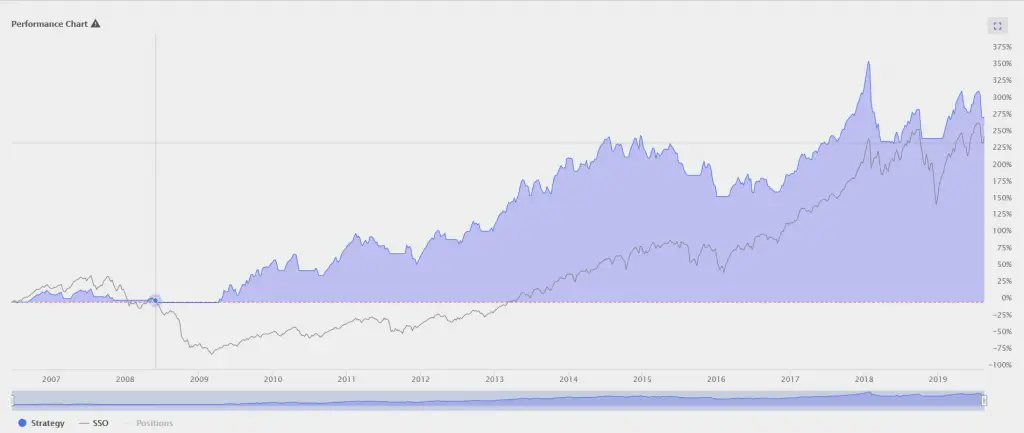

You can see that the 10/50 day EMA backtest returned +275% versus buy and hold at +240% going back to 2007 for a positive mean return of +4.17% per trade. The big difference in the trend signal versus the buy and hold approach is the risk adjusted return. The $SSO ETF experienced a -84.7% drawdown during the financial crises that you can see from the below equity curve and stayed under water for a long time while the 10/50 day EMA signaled to be in cash. The 10/50 day EMA crossover strategy had only a -29.6% draw down even though it beat buy and hold.

The below chart is a zoomed in view of the current signals and below is a comparison of the equity curves of the crossover signal versus buy and hold on the $SSO chart.

To create you own trend trading strategies you need to backtest your watch list across multiple moving average signals to see which ones would have captured trends in the past and create a good probability of catching trends in the present and future.

Chart and backtesting Data Courtesy of TrendSpider.com.

This article is for informational purposes only and is not investment advice.