Market Wizard Richard Dennis known as the ‘Prince of the Pit’ turned $1,600 into $200 million in 10 years trend trading commodities.

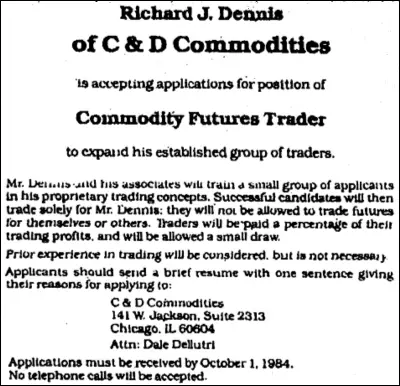

What happened when legendary trader Richard Dennis put a want ad in the paper to hire traders? What kind of results would ordinary people have if they were given a winning system and a million dollar account? The results will surprise you. This experiment was over an argument that Richard Dennis had with his trading partner over whether traders were born or could be trained. The first class was started in 1984 with about 14 students in the first class. After 2 weeks of training they were given real accounts to trade. The returns were very volatile month by month but like their mentor, most averaged returns of 50-100% a year. In the end Richard Dennis was correct, and his firm successfully produced several traders that became millionaires, one went on to manage a billion dollar fund. Many others went on to successfully manage large capital professionally.

The Turtles were taught trend following along was risk management. The program wanted to get all the traders to trade the system they were given. They were taught to not think in terms of money, they wanted money to be more abstract so they could think clearly without the pressure that thinking in terms of cash creates. A bad month, a bad quarter, or even a bad year does not mean much in the grand scheme of a trading career. They would only maintain trades in a trending market with the goal being to catch a large part of a move. Richard Dennis wanted them to follow rules and avoid making judgments by following emotions or opinions. The turtles were technical based trend following traders with the belief being that price is reality. They traded price action not news or fundamentals. They had two systems they could use. Below is the system they used.

Most of the traders that could follow the rules went on to be millionaires and to manage money professionally.

The Turtle system was a complete trading system.

Markets – What to buy or sell

- The Turtles traded all major futures contracts, metals, currencies, and commodities.

- The turtles traded multiple markets to diversify risk.

Position Sizing – How much to buy or sell

- Turtle position sizing was based on a markets volatility using the 20 day exponential moving average true range.

- The Turtles were taught to trade in increments of 1% of total account equity,

Entries – When to buy or sell

- The Turtles traded a Donchian breakout system, System 1 entered a 20 day break out and System 2 entered a 55 day break out.

- Positions were added to in a winning trend. (pyramiding)

Stops – When to get out of a losing position

- System 1 exited at a 10 day break out in the opposite direction of the entry and System 2 exited at 20 day break out in the opposite direction of the entry.

- No trade could incur more than a 2% equity risk, stop losses were planned accordingly

Tactics – How to buy or sell

- The most important aspects of successful trading is confidence, consistency, and discipline.

- The Turtles believed that successful traders used mechanical trading systems.

- They traded liquid markets only.

Turtle traders bought strength, sold weakness, controlled risk, and followed their rules.

Here is a document containing all the original Turtle Trading rules from an original Turtle>>>> Click Here

An excellent book about the Turtle trading program is The Complete Turtle Trader by Michael Covel.

It was truly a landmark experiment in trend following’s success rates.

The answer to Dennis’ question on whether traders were born that way or if they could be taught? If they could follow rules of trading systems that had an edge they could be successful.

Richard Dennis quoted from the book Market Wizards: “I always say that you could publish my trading rules in the newspaper and no one would follow them. The key is consistency and discipline. Almost anybody can make up a list of rules that are 80% as good as what we taught our people. What they couldn’t do is give them the confidence to stick to those rules even when things are going bad.”