No trading strategy works all the time because the market doesn’t stay the same. Markets change from range bound, to trending, and at times become very volatile but go nowhere. Quantified trading signals can be based on different types of price action patterns created in different types of market environments. Trend traders buy high in the hopes of selling higher, while swing traders try to create a great risk/reward ratio by buying low hoping to sell on rebounds in price action.

Here are four different types of price action patterns:

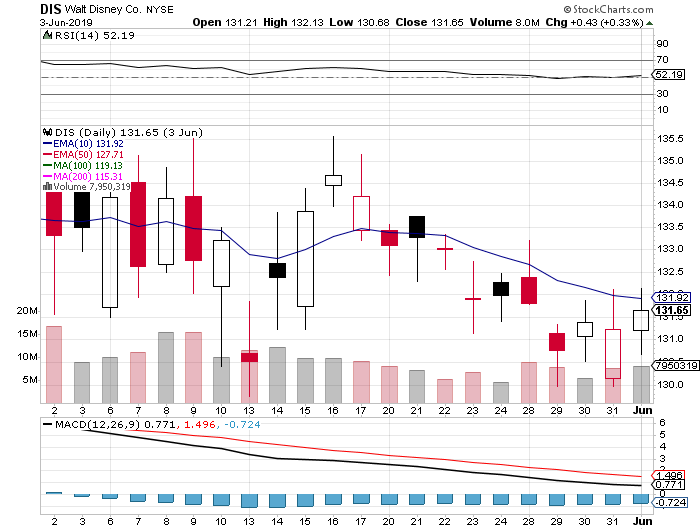

Chart in an uptrend:

An uptrend is defined by a chart that has higher highs and higher lows over the duration of the time period. When a chart quits making new highs and starts under cutting previous lows over and over the uptrend has begun to bend. Price remaining over the moving averages equal to the time frame is a simple indicator to quantify a trend. Moving average crossover signals are one way to trade trends. Long positions are rewarded in an uptrend whether riding the uptrend or buying the dip.

Chart Courtesy of Stockcharts.com

Chart in an downtrend:

A downtrend is defined by a chart that has lower highs and lower lows over the duration of the time period. When a chart quits making new lows and starts breaking above previous highs over and over the downtrend has begun to bend. Price remaining under the moving averages equal to the time frame is a simple indicator to quantify a trend. Moving average cross under signals are one way to trade downtrends. Short positions are rewarded in a downtrend whether riding the downtrend or selling short into rallies. Staying in cash also prevents losses in a downtrend if you are normally on the long side.

Chart Courtesy of Stockcharts.com

A Range Bound Chart:

A range bound chart has a defined level of support where buyers come in at that price so it does not go lower there multiple times. A range bound chart also a defined level of resistance where there are no buyers above that price so it does not go higher there multiple times. A range bound chart starts to convert to a trend after price breaks above resistance or below support and starts to move away from the established price range. Buying support and selling resistance is rewarded on a range bound chart.

Chart Courtesy of Stockcharts.com

A Volatile Chart:

A volatile chart has price action with no long term defined trading range or trend in any direction. Price can experience a lot of gaps in both directions and can go back and fill those gaps. On a volatile chart a price will break out of a trading range and then return inside the range. The daily trading range will expand as measured by the Average True Range (ATR) on a volatile chart. On a volatile chart few signals or systems work for more than a few days and all the false signals are expensive to be stopped out of. For most people it is better to avoid choppy volatility when no clear signals are given to trade.

Chart Courtesy of Stockcharts.com